What is a Cash Flow Statement?

The Cash Flow Statement records actual cash movements – when money hits or leaves the bank. Unlike the Income Statement (accrual-based), the cash flow report answers: Can we pay payroll and suppliers tomorrow? Banks and investors use it to assess the quality of earnings: high profit with negative operating cash flow signals earnings tied up in receivables or inventory.

Is a Cash Flow Statement Mandatory for Singapore SMEs?

Yes, preparing a cash flow statement is required under Singapore’s financial reporting framework (SFRS(I) 7). Filing obligations with ACRA differ by company type:

- Publicly Listed Companies: Must file full financial statements including cash flows.

- Non-Publicly Accountable Entities: Generally must include a cash flow statement in the annual financials.

Exempt Private Companies (EPCs): Solvent EPCs may be exempt from filing full XBRL financials with ACRA but still should prepare full statements for internal control, bank lending, and potential IRAS audits; insolvent EPCs must file full statements. Koobiz recommends all EPCs prepare a cash flow statement regardless of filing exemption – banks and grant assessors expect it.

Cash Flow vs. Net Profit: The “Gap”

- Timing: Profit is recognised when earned; cash is recorded when received.

- Non-cash items: Depreciation reduces profit but not cash — it’s added back in the cash-flow reconciliation.

- CapEx: Equipment purchases reduce cash immediately but are expensed over time in P&L.

Example: Invoice S$50,000 in Jan, 60-day credit. P&L shows revenue in Jan; cash arrives in Mar. If payroll and rent fall due before collection, the company can be unable to pay despite showing profit.

The Three Key Components

To monitor liquidity accurately, cash movements are separated into three “buckets”:

1. Cash Flow from Operating Activities (CFO)

Cash generated from core business operations.

- Inflows: Customer receipts.

- Outflows: Payments to suppliers, employees, and IRAS.

Insight: A consistently negative CFO indicates the business model is not self-sustaining and relies on external funding.

2. Cash Flow from Investing Activities (CFI)

Cash used for buying or selling long-term assets (Capital Expenditure).

- Outflows: Buying computers, machinery, or software.

- Inflows: Selling old equipment.

Insight: Negative CFI often signals a growing company investing in its future capacity.

3. Cash Flow from Financing Activities (CFF)

Cash flow between the company, its owners, and creditors.

- Inflows: Issuing shares or taking bank loans.

- Outflows: Paying dividends or repaying loan principals.

Insight: High inflows mean the company is raising capital; high outflows mean it is servicing debt.

Preparation: Direct vs. Indirect Method

While SFRS(I) 7 encourages the Direct Method, the Indirect Method is standard for Singapore SMEs due to its simplicity and integration with software like Xero.

- Direct method: Lists cash receipts and payments. Readable but hard to compile from accrual-ledgers.

- Indirect method (recommended for SMEs): Start with Net Profit, add back non-cash items (e.g., depreciation), then adjust for working capital changes (Δ receivables, payables, inventory). It maps cleanly from the P&L and balance sheet. Koobiz’s accounting services can automate this reconciliation from Xero/QuickBooks exports.

Case Study: The “Profitable but Poor” Dilemma

Scenario: SingaTrading Pte Ltd closes January 2025 with a fantastic Income Statement but struggles to pay February rent.

Financial Snapshot (January 2025):

| Metric | Income Statement (Accrual) | Cash Flow Statement (Actual) |

|---|---|---|

| Revenue / Inflow | S$100,000 (Invoiced) | S$70,000 (Collected) |

| Expenses / Outflow | (S$80,000) (Incurred) | (S$95,000) (Paid) |

| Bottom Line | + S$20,000 (Profit) | – S$25,000 (Cash Drain) |

The Diagnosis:

- Operating (Root Cause): Customers haven’t paid S$30,000 yet (Accounts Receivable), while SingaTrading paid suppliers immediately.

- Investing: They spent S$5,000 upfront on software.

- Result: Despite S$20,000 profit, they are S$25,000 poorer in cash.

The Fix: The Director must chase debt collection or negotiate 30-day credit terms with suppliers. Profit is an opinion; Cash is a fact.

Practical Example: Sample Cash Flow Statement (Indirect Method)

Here is a simplified standard format for a Singapore SME.

| Line Item | Amount (SGD) | Category |

|---|---|---|

| Net Profit (from P&L) | $50,000 | Starting Point |

| Adjustments: | ||

| (+) Depreciation | $5,000 | Non-cash expense |

| Working Capital Changes: | ||

| (-) Increase in Receivables | ($20,000) | Cash not yet collected |

| (+) Increase in Payables | $10,000 | Cash preserved (bills unpaid) |

| (-) Tax Paid to IRAS | ($5,000) | Actual outflow |

| Net Cash from Operating (A) | $40,000 | Actual Business Cash |

| Investing Activities: | ||

| (-) Purchase of Computers | ($15,000) | CapEx |

| Net Cash used in Investing (B) | ($15,000) | Growth Spend |

| Financing Activities: | ||

| (+) Bank Loan Proceeds | $50,000 | Inflow |

| (-) Loan Repayment | ($8,000) | Outflow |

| Net Cash from Financing (C) | $42,000 | Funding |

| Net Increase in Cash (A+B+C) | $67,000 | Total Movement |

Singapore Strategic Context: Grants and GST

Beyond standard preparation, local factors significantly impact cash flow timing.

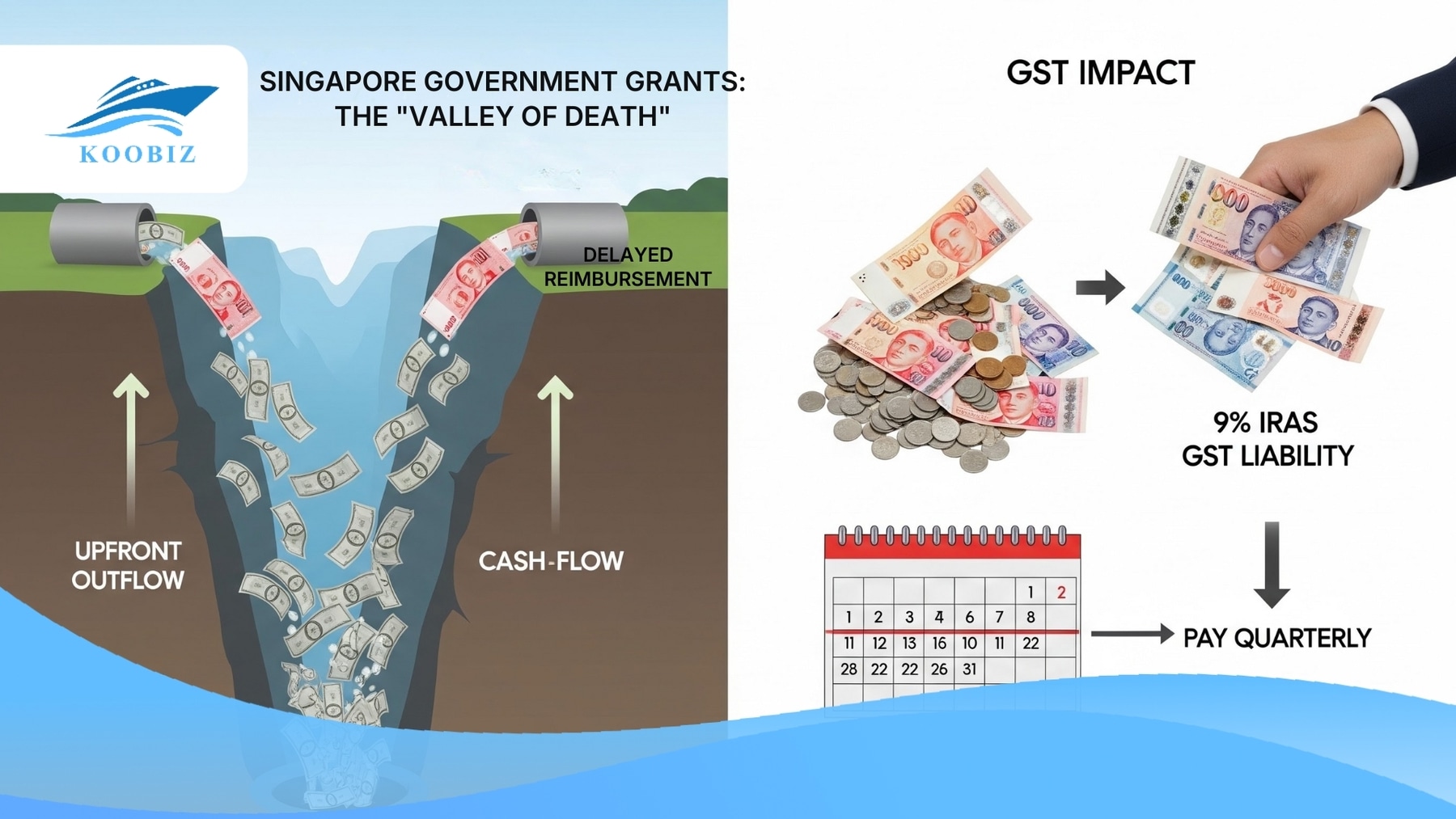

1. The “Valley of Death” in Government Grants

Grants like the Productivity Solutions Grant (PSG) and Enterprise Development Grant (EDG) are vital for SMEs, but they operate on a reimbursement basis.

- The Trap: You must pay the vendor 100% upfront.

- The Lag: Reimbursement (up to 50-70%) takes 1–3 months (or longer) after the claim is approved via the Business Grants Portal.

- Impact: Your cash flow takes a massive hit in the month of purchase. Without bridge financing, a “grant-supported” project can cause a liquidity crisis.

2. GST Impact (9% Rate)

For GST-registered businesses, GST collected is a liability, not revenue.

- Flow: You collect 9% GST on sales (increasing cash balance) but must pay it to IRAS quarterly.

- Risk: If you spend this “extra” cash, you will face a shortfall when tax filing is due.

Koobiz Tip: Consider the Major Exporter Scheme (MES) if you are a significant exporter. It allows you to import non-dutiable goods with GST suspended, significantly easing cash flow pressure.

Common Warning Signs

- If CFO is consistently negative, you are burning cash to sustain operations. You are surviving only by selling assets or borrowing.

- A company can be solvent (Assets > Liabilities) but illiquid (Cash tied up in stock). If you cannot pay debts as they fall due, creditors can wind you up.

- If it takes 90 days to sell and collect, but you pay suppliers in 30 days, you have a 60-day funding gap.

Conclusion

Preparing a Cash Flow Statement under SFRS(I) 7 is not just a compliance exercise; it is a survival tool. By separating paper profit from actual liquidity and navigating Singapore’s specific grant and tax lags, you secure your business’s future.

At Koobiz, we simplify Singapore’s financial reporting standards for you. Whether you need help with incorporation, corporate bank account opening, or accounting services to maintain healthy cash flow, our team is ready to assist.

Visit Koobiz.com to optimize your financial strategy today.