Confused about the difference between a Singapore ROC number and a UEN? You aren’t alone. Whether you are a foreign investor looking to incorporate a new entity or a supplier conducting due diligence on a potential partner, If a bank or partner asks for your ROC Number, don’t panic—they are actually looking for your UEN.

At Koobiz, we frequently assist clients with Singapore company incorporation and bank account opening, and clarifying these identifiers is the first step toward compliance. This guide will verify the meaning of the Singapore ROC Number, detail its specific formats, and provide a comprehensive manual on how to search and validate these numbers effectively.

What is a Singapore ROC Number?

Essentially, the ROC Number (now UEN) is your company’s ‘Identity Card’ issued by ACRA.. It is assigned to entities upon incorporation by the Accounting and Corporate Regulatory Authority (ACRA). It’s essentially your company’s NRIC or ‘Identity Card’.

To understand its significance, we must look at its function within the national ecosystem. Just like every Singaporean has an NRIC, every registered business must have a UEN to operate legally. It is not merely a registration string. It is a mandatory requirement for filing corporate tax returns with IRAS, submitting employer contributions to the CPF Board, and applying for import/export permits. Without this number, your business is effectively ‘frozen’—you cannot pay taxes, hire staff via CPF, or even apply for trade permits. For clients at Koobiz, obtaining this number is the immediate milestone following the successful incorporation of their company.

Examples of ROC Numbers (UEN)

To give you a clear visual understanding, here is what these unique identifiers typically look like across different business types:

- Local Company (Pte Ltd): 201012345K(A standard 10-digit format usually starting with the year of incorporation, e.g., 2010)

- Sole Proprietorship / Partnership (Pre-2009): 53123456A(Typically starts with specific digits like ’52’, ’53’ or ’54’ and does not include the year)

- Limited Liability Partnership (LLP): T19LL1234G(Contains the entity type code ‘LL’ and the year of registration ‘T19’ for 2019)

Is the ROC Number the same as the UEN?

Yes, the ROC Number is essentially the same as the UEN (Unique Entity Number). The latter was introduced to replace and consolidate all previous identification numbers into a single standard.

In 2009, Singapore simplified its regulatory system by replacing various IDs with a single UEN. Prior to 2009, businesses had different identification numbers for interacting with different government bodies. The Registrar of Companies (ROC) issued numbers for companies, while the Registrar of Businesses (ROB) issued numbers for sole proprietorships. Legacy entities registered before 2009 might have retained simpler, shorter formats which were migrated into the UEN system.

On 1 January 2009, the Singapore government implemented the UEN system. While the official term is now “UEN,” many long-standing business owners, bankers, and administrative professionals still colloquially refer to it as the “ROC Number.” Therefore, when a vendor asks for your ROC number, they are requesting your UEN. Bottom line: If a vendor or banker asks for your ‘ROC number,’ they just want your UEN. Using the right term avoids confusion.

Singapore ROC Number Format and Structure

There are two main structural categories for the ROC Number (UEN) in Singapore: one for local companies and another for businesses and other registered bodies.

Decoding the Format

A quick look at the UEN format can tell you exactly what kind of entity you are dealing with. A trained eye can look at a UEN and immediately discern the type of entity and, in many cases, the year of its incorporation. This ability to decode the number is a skill we cultivate at Koobiz to ensure our accounting and auditing services are precise.

Standard Format for Local Companies

The standard format for local companies incorporated in Singapore follows the syntax YYYYnnnnnX (10 characters), where “YYYY” represents the year of incorporation, “nnnnn” is a sequential number, and “X” is a check alphabet.

For instance, a company incorporated in 2023 might have a UEN like 202312345K. This format applies to Private Limited Companies (Pte Ltd) and Public Companies. Due Diligence Tip: The first four digits reveal the company’s registration year. If a ‘long-standing’ partner has a UEN starting with 2024, it’s a red flag.

Format for Businesses and LLPs

The format for businesses varies slightly depending on when they were registered.

- Pre-2009 Registration: Sole proprietorships and partnerships registered before 2009 often follow a 9-digit format (e.g., 53123456A). These typically consist of 8 numbers followed by a check alphabet.

- Post-2009 Registration: Businesses and Limited Liability Partnerships (LLPs) registered after 2009 follow the syntax TyyPQnnnnX.

In the TyyPQnnnnX format (e.g., T23LL1234A), the components break down as follows:

- Tyy: The year (e.g., T23 for 2023).

- PQ: The entity type code.

- LL: Limited Liability Partnership

- LP: Limited Partnership

- BN: Businesses (Sole Proprietorships/Partnerships)

- nnnn: Sequence number.

- X: Check digit.

Understanding this structure helps you verify if the entity you are dealing with matches the legal structure they claim to have.

How to Search and Verify an ROC Number in Singapore?

Don’t take a UEN at face value. Before signing contracts or wiring funds, verifying a company’s status is a non-negotiable step.

Let’s explore the most reliable methods to perform this check. With online scams on the rise, simply having a UEN doesn’t prove a company is legitimate. You must confirm it is currently ‘Live’. Koobiz recommends that all our clients perform this due diligence before signing contracts or transferring funds.

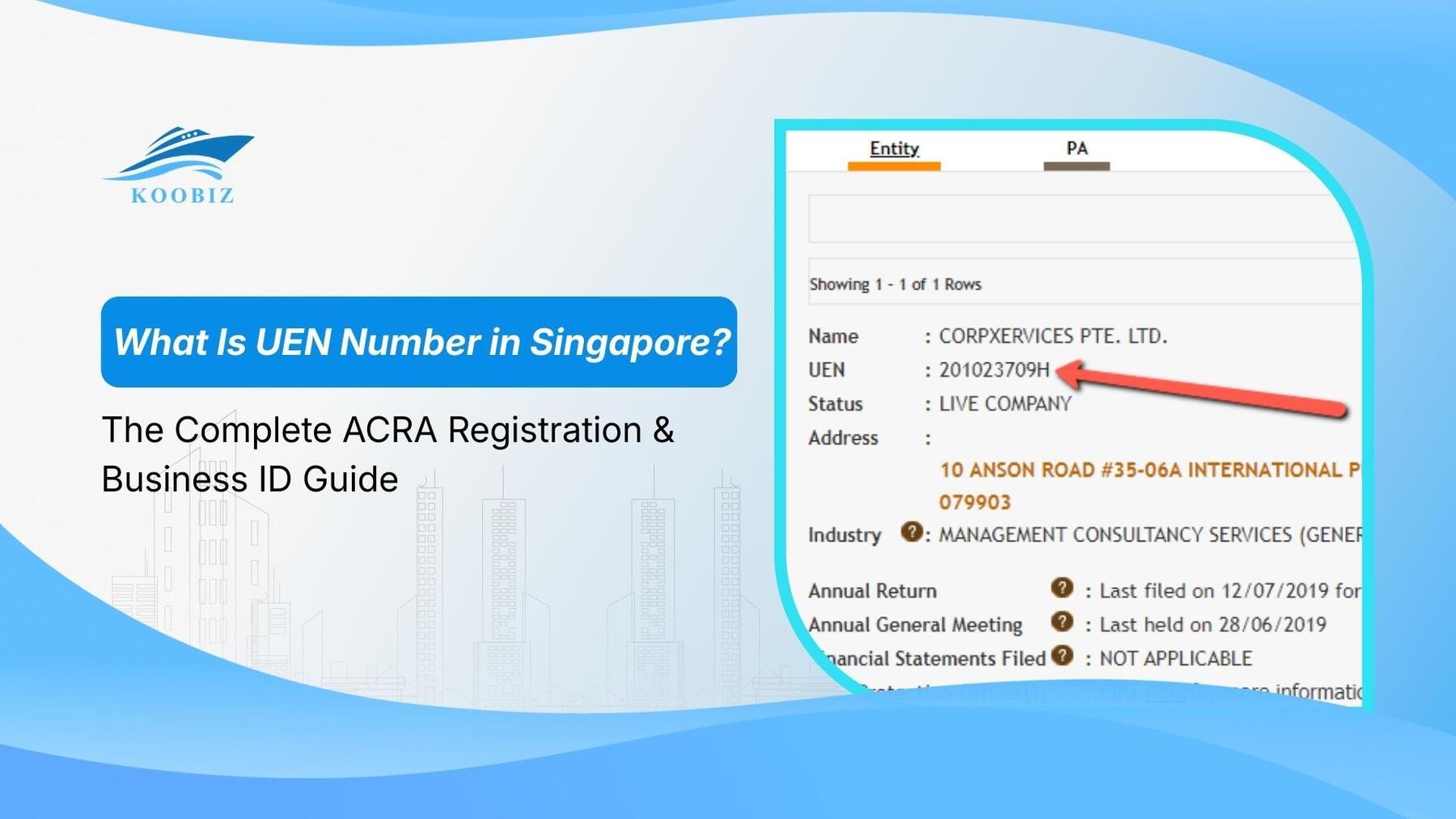

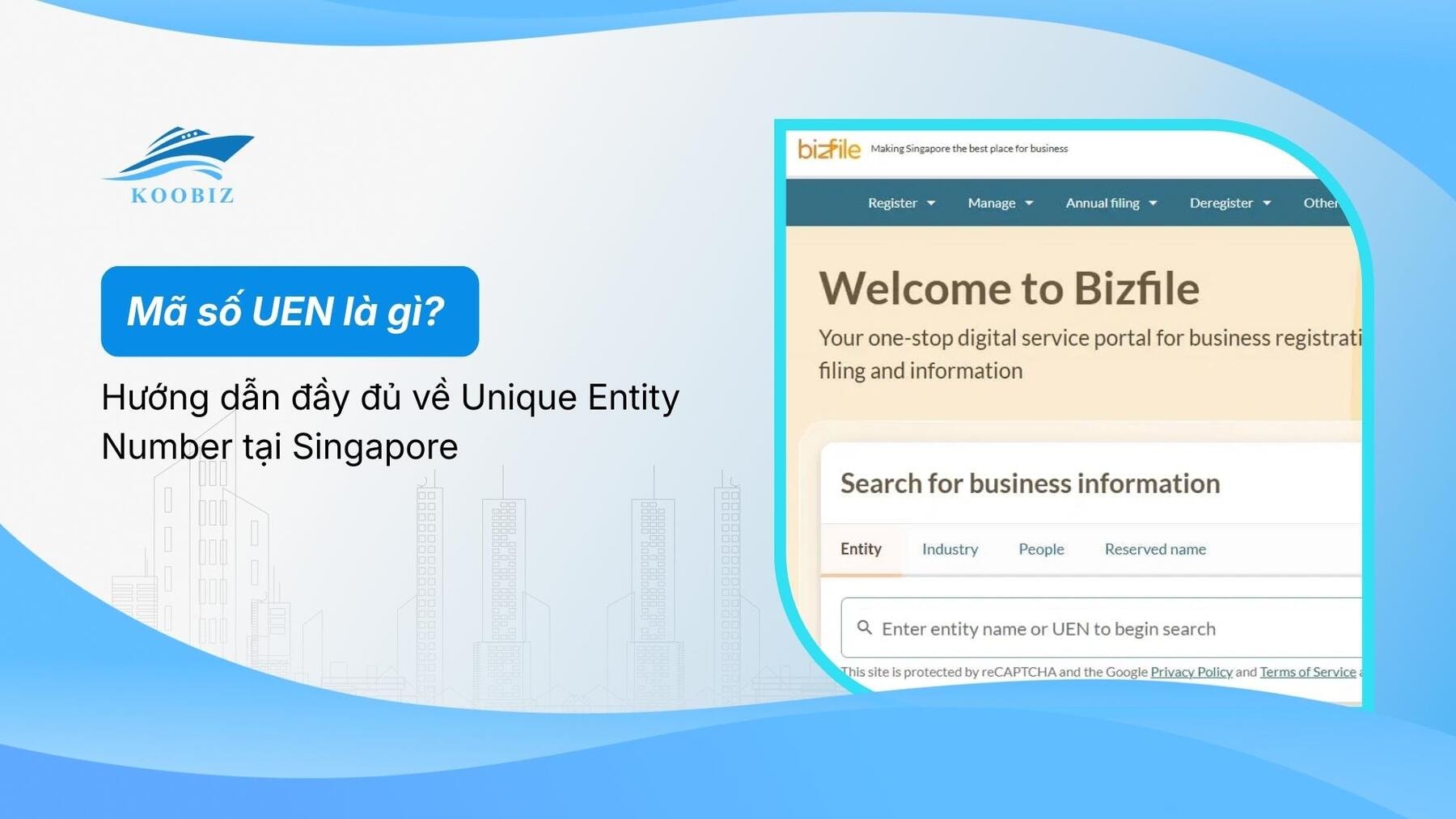

Method 1: Using the ACRA BizFile+ Portal

The most authoritative method is using the ACRA BizFile+ portal, which provides real-time data directly from the government database.

Step-by-step Guide:

- Access the Portal: Go to the official ACRA website (bizfile.gov.sg).

- Locate Search Bar: Look for the “Search for Business Entity” box.

- Enter Details: Input the UEN (ROC Number) or the full company name.

- Check the Status: This is the most critical part. Look for the ‘Status’ field immediately.

- Live: The company is active and existing.

- Struck Off: The company has been closed and deregistered.

- Winding Up: The company is in the process of closing (possibly due to insolvency).This method is free for basic information and is the gold standard for verification.

Method 2: Checking via Third-Party Directories

Apart from ACRA, you can check via third-party business directories like SGP Business or Opencorp, which aggregate public data for easier browsing.

Third-party sites are great for quick research, but they often have a data lag. For legal or financial finality, stick to ACRA.There can sometimes be a lag between an update in ACRA’s system and the third-party directory. For critical legal checks—such as verified ownership for bank account opening or large-scale supplier contracts—always cross-reference with the official ACRA BizFile+ results.

Real-World Case Study: Verifying a Potential Partner

Let’s see how this works in the real world. Imagine you’re about to wire money to a new supplier, “Lion City Tech Solutions.” They send you an invoice with their ROC Number (UEN).

Step 1: Analyze the UEN on the Invoice

- Provided UEN: 202012345W

- Format Check: It starts with “2020”, indicating the company was incorporated in 2020. It follows the 10-digit format (YYYYnnnnnX) for a Local Company. The format matches a Local Company registered in 2020. So far, so good.

Step 2: Perform the ACRA Search

You enter 202012345W into the BizFile+ portal search bar.

Step 3: Interpret the Results

Here are three possible outcomes and how you should react:

- Scenario A (The Verified Success):

- Result: The status is “Live”, and the registered address matches the address on the invoice.

- Action: You can proceed with the transaction with confidence.

- Scenario B (The “Struck Off” Warning):

- Result: The status shows as “Struck Off”.

- Meaning: This company has been deregistered and does not legally exist anymore. It cannot enter into binding contracts.

- Action: Do not transfer funds. This is a major red flag indicating potential negligence or fraud.

- Scenario C (The Data Mismatch):

- Result: The status is “Live,” but the company name listed is “Orchid Flower Shop,” not “Lion City Tech Solutions.”

- Meaning: The supplier might be using another company’s UEN to appear legitimate.

- Action: Pause immediately. Ask the supplier to explain the discrepancy. This is a hard stop. A ‘Struck Off’ status means the entity no longer legally exists. Do not transfer funds.

Where Must the ROC Number (UEN) Be Displayed?

To stay on the right side of the law, you must display your UEN in several mandatory locations.

The Singapore Companies Act isn’t a suggestion—it’s a requirement. Missing UENs can lead to unnecessary fines. Failure to display the UEN on specific documents can lead to penalties and a loss of credibility. At Koobiz, we advise our secretarial clients to audit their stationery and digital footprints immediately after incorporation to ensure these numbers are visible.

Official Business Documents (Invoices & Receipts)

Companies must print their UEN on all statements of account, invoices, official notices, and publications.

From invoices to official letterheads, your UEN needs to be there. Without it, your tax invoices might be rejected for GST claims. When you issue a tax invoice to a client, the absence of a UEN renders the invoice invalid for GST input tax claims by your client, potentially causing friction in business relationships. It effectively proves that the entity charging the money is a legally registered body authorized to conduct business.

Corporate Communications and Websites

Your digital presence needs to be as compliant as your paperwork.

Since your website is usually a client’s first point of contact, transparency is key. Placing the UEN in the footer of your website is industry standard practice in Singapore. It signals legitimacy to visitors. For professional firms, adding the UEN to email signatures isn’t just a rule—it’s about establishing trust.

Can a Company Have an ROC Number Without ACRA Registration?

Yes, specific entities obtain UENs from designated government agencies other than ACRA, depending on their nature and purpose.

Not every UEN comes from ACRA. Depending on your organization, a different government body might be your registrar. While ACRA is the Registrar for standard business entities (Pte Ltd, LLP, Sole Prop), it does not govern every organization in Singapore. Don’t assume a number is fake just because it’s missing from BizFile+. You might just be looking in the wrong registry.

List of Other UEN Issuance Agencies

Several specialized bodies issue UENs for non-business entities, creating a decentralized but unified identification network.

- ROS (Registry of Societies): Issues UENs for registered societies (e.g., social clubs, clan associations).

- MCCY (Ministry of Culture, Community and Youth): Issues UENs for charities and institutions of a public character.

- MOM (Ministry of Manpower): Issues UENs for trade unions.

- Moe (Ministry of Education): Issues UENs for schools and educational institutions.If you cannot find a UEN on ACRA BizFile, verify the nature of the organization. If it is a charity or a society, you must search the respective portal (e.g., the Charity Portal) rather than ACRA.

Common Mistakes Regarding ROC Numbers

One of the costliest mistakes a business can make is mixing up the UEN with other tax IDs.

Avoiding these errors ensures smooth operations, particularly when dealing with tax filing and billing. Misidentifying these numbers can lead to rejected GIRO arrangements or failed invoice payments.

Confusing GST Registration Number with ROC Number

Is your UEN your GST number? Not always. It’s a common trap for new business owners.

For most local companies, the GST Registration Number is the same as the UEN. For example, a company with UEN 200312345A will likely use that exact number as its GST number. However, having a UEN does not automatically mean the company is GST-registered. GST registration is only mandatory for businesses with a taxable turnover exceeding SGD 1 million.

Don’t assume you can charge GST just because you have a UEN. There’s a big difference between being registered and being authorized. For GST-registered entities, always confirm their specific status via the IRAS’s free search tool (mytax.iras.gov.sg) to avoid mismatches. Keep in mind that foreign companies might use a unique GST number that doesn’t look like a standard local UEN.

Conclusion

Mastering the UEN system is more than just paperwork—nurturing this knowledge protects your business from fraud and compliance slip-ups.From recognizing the YYYYnnnnnX format to mastering the verification process on ACRA BizFile+, these details protect your business interests and ensure compliance.

Whether you are just starting your journey or looking to streamline your existing operations, Koobiz is here to support you. We specialize in Singapore company incorporation, ensuring your entity is registered correctly with a valid UEN from day one. Our team also handles the heavy lifting—from corporate bank accounts to complex tax and auditing requirements.

Visit Koobiz.com today to set up your Singapore company with confidence.