Understanding Singapore’s tax landscape is essential for operating legally. This guide explains the Singapore GST registration requirements, focusing on the SGD 1 million threshold, how turnover is calculated, and the choice between mandatory and voluntary registration. We also cover special scenarios like the Overseas Vendor Registration regime to help you stay compliant while optimizing your tax position.

Is GST Registration Mandatory for Your Singapore Business?

Yes. You must register for GST if your taxable turnover exceeds SGD 1 million.

This is not optional. Once you hit the threshold, IRAS rules apply. Quick facts:

- Threshold: > SGD 1 million (Taxable Turnover).

- Current Rate: 9% on goods and services.

- Basis: Liability is based on Revenue, not Profit.

- Risk: Failing to register can lead to significant penalties

Crossing the SGD 1 million mark is a big milestone. It also means you need to calculate turnover accurately to stay compliant.

Understanding the $1 Million Taxable Turnover Threshold

Taxable turnover is the total value of all standard-rated and zero-rated supplies made in Singapore, and it excludes exempt and out-of-scope supplies.

There are two ways IRAS requires you to look at turnover. It’s important to know what counts and what doesn’t:

- Standard-rated supplies: Goods and services sold in Singapore (taxed at 9%).

- Zero-rated supplies: Exports and international services (0%), which still count toward the threshold even though no tax is collected.

- Exempt supplies: Some financial services, sale/lease of residential properties, and certain metals are exempt.

- Out-of-scope supplies: Sales from outside Singapore to outside Singapore (third-country sales) are not counted.

To ensure you are compliant, you must apply the following two views.

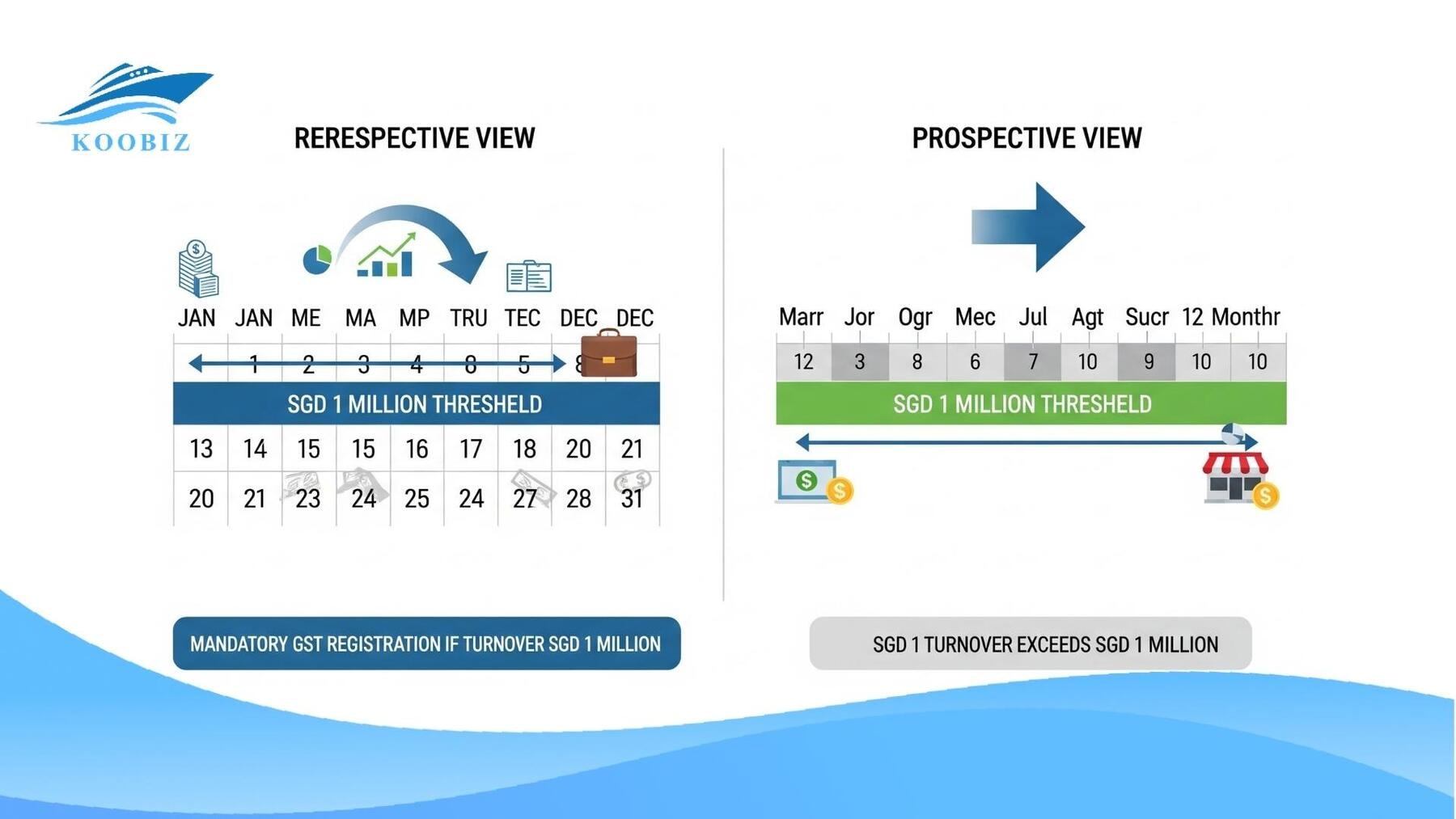

The Retrospective View (End of Calendar Year)

The Retrospective View requires you to assess your turnover strictly at the end of the calendar year (31 December).

You must sum up your taxable turnover for the calendar year (1 Jan to 31 Dec). If the total exceeds SGD 1 million, you must register.

- Check Date: 31 December.

- Deadline: You must apply by 30 January of the following year.

- Effective Date: You will be registered on 1 March of that year.

Note: While the mandatory check is annual, we recommend monitoring your turnover quarterly to anticipate this liability.

The Prospective View (Next 12 Months)

The Prospective View mandates registration if there is reasonable certainty that your taxable turnover will exceed SGD 1 million in the next 12 months.

This method looks forward and is often triggered by large contracts or business restructuring. “Reasonable certainty” usually means you have signed sales contracts or confirmed purchase orders. It is not based on vague sales targets or optimistic projections.

- Deadline: You must apply strictly within 30 days of the date on which your forecast indicates you will exceed the threshold.

- Effective Date: Registration usually starts two months from the date of your forecast (for liabilities arising on or after 1 July 2025). This extended grace period provides ample time to set up your accounting systems.

According to data from IRAS, failing to apply the prospective view is a common error for rapidly scaling startups. If you sign a contract worth SGD 1.2 million today, you must register immediately, even if you haven’t issued a single invoice yet.

Voluntary GST Registration: Benefits and Responsibilities

Voluntary registration lets you claim input tax on your purchases, but it comes with ongoing obligations.

Why Choose Voluntary Registration? (Pros)

The primary advantage of voluntary registration is the ability to claim input tax incurred on business purchases and the enhancement of corporate image.

Specifically, choosing to register voluntarily offers the following Benefits:

- Recover Input Tax: You can reclaim GST paid on business expenses (rent, imports, vendor fees, etc.).

- Enhance Corporate Image: Being GST-registered can signal stability to suppliers and lenders.

- Neutral Impact on B2B: If most clients are GST-registered, charging GST is straightforward for them.

Cons and Obligations of Voluntary Registration

The drawbacks include a compulsory lock-in period, heightened administrative and compliance expenses, and stringent payment obligations. Before submitting an application, businesses must be ready to assume the following Responsibilities:

- Mandatory InvoiceNow Adoption: For voluntary registration applications submitted on or after 1 November 2025 (for newly incorporated companies) or 1 April 2026 (for all other entities), businesses are required to employ InvoiceNow-compatible software to directly transmit invoice data to IRAS.

- 2-Year Lock-in Period: Upon registration, the business must maintain its GST-registered status for a minimum of two years. Deregistration is not permitted merely due to administrative burden.

- Mandatory GIRO: IRAS typically mandates voluntary registrants to enrol in GIRO for automated tax deductions, ensuring payment security.

- Strict Filing & Record Keeping: GST returns must be filed punctually (generally on a quarterly basis), and all accounting records must be maintained for at least five years.

- Additional Compliance Costs: For smaller enterprises, the administrative workload or the expense of engaging professional accounting services may occasionally exceed the recoverable input tax.

Koobiz often conducts a Cost-Benefit Analysis for clients to see if the recoverable tax covers the cost of hiring professional accounting services.

Comparison: Mandatory vs. Voluntary Registration

Mandatory registration is a legal requirement triggered by specific turnover thresholds, accompanied by immediate and rigid deadlines. In contrast, voluntary registration is a strategic business decision offering a flexible application timeline but entailing a long-term commitment. Grasping these distinctions is vital for effective strategic planning. The following table outlines key differences essential for business owners in Singapore.

| Feature | Mandatory Registration | Voluntary Registration |

|---|---|---|

| Trigger | Taxable turnover > SGD 1M (Past or Future). | Strategic decision by business owner. |

| Application Timeline | By 30 Jan (Retrospective) or within 30 days (Prospective). | Anytime, provided the business is active. |

| De-registration | Only when turnover drops < SGD 1M or business ceases. | Minimum 2-year lock-in period required. |

| Compliance Risk | High penalty for late registration. | Risk of rejection if business intent is unclear. |

| Primary Benefit | Legal compliance (avoiding jail/fines). | Recovering input tax (cost savings). |

Unsure if you’ve hit the threshold? Contact Koobiz for a free eligibility assessment.

Case Studies: Real-World Scenarios

To illustrate how these regulations are applied, consider the following common scenarios, which highlight specific deadlines and effective dates.

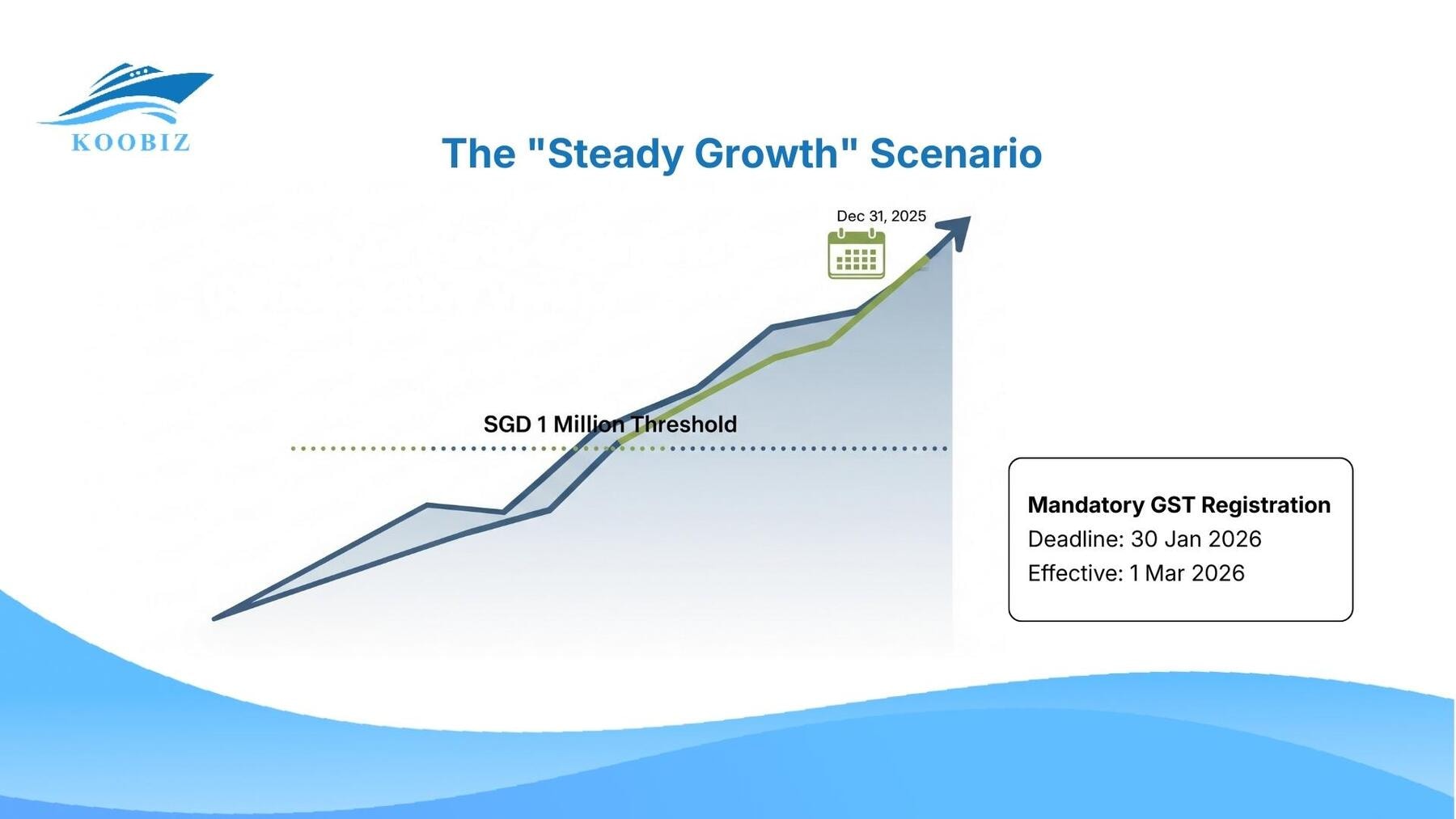

Case 1: The “Steady Growth” Scenario (Retrospective View)

Situation: “TechGadgets Pte Ltd” reviews its accounts on 31 December 2025. They realize their total taxable turnover for the calendar year (Jan–Dec 2025) was SGD 1.2 million.

- Verdict: They are liable to register.

- Deadline to Apply: They must submit the application by 30 January 2026.

- Effective Date: They will become a GST-registered business on 1 March 2026.

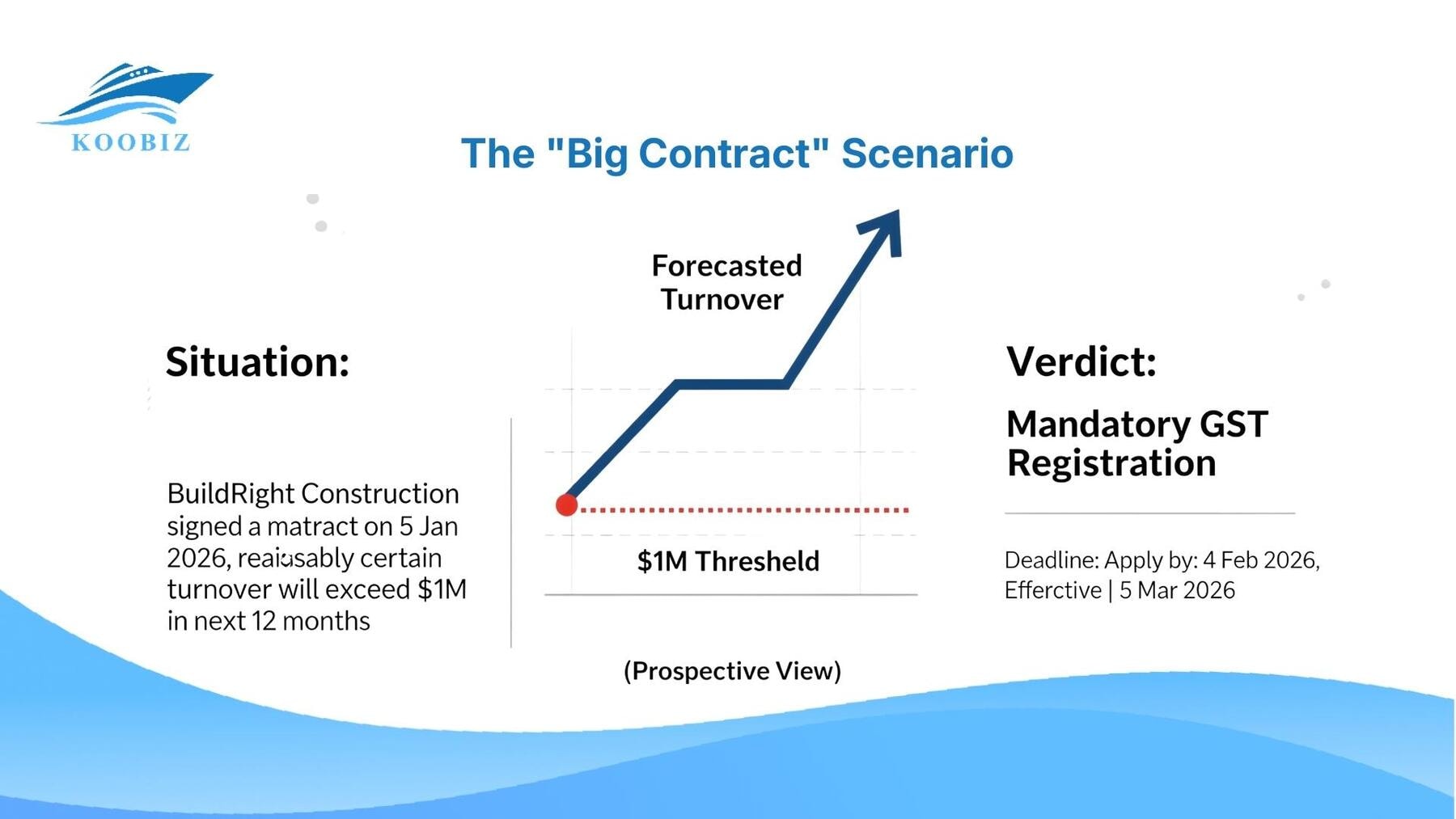

Case 2: The “Big Contract” Scenario (Prospective View)

Situation: “BuildRight Construction” signs a major contract on 5 January 2026.

- Verdict: Even though they haven’t issued a single invoice yet, they are “reasonably certain” turnover will exceed $1M in the next 12 months.

- Deadline to Apply: They must apply by 4 February 2026 (within 30 days of the forecast date).

- Effective Date: Under the rules for liabilities arising after 1 July 2025, their registration will be effective on 5 March 2026 (strictly two months from the forecast date).

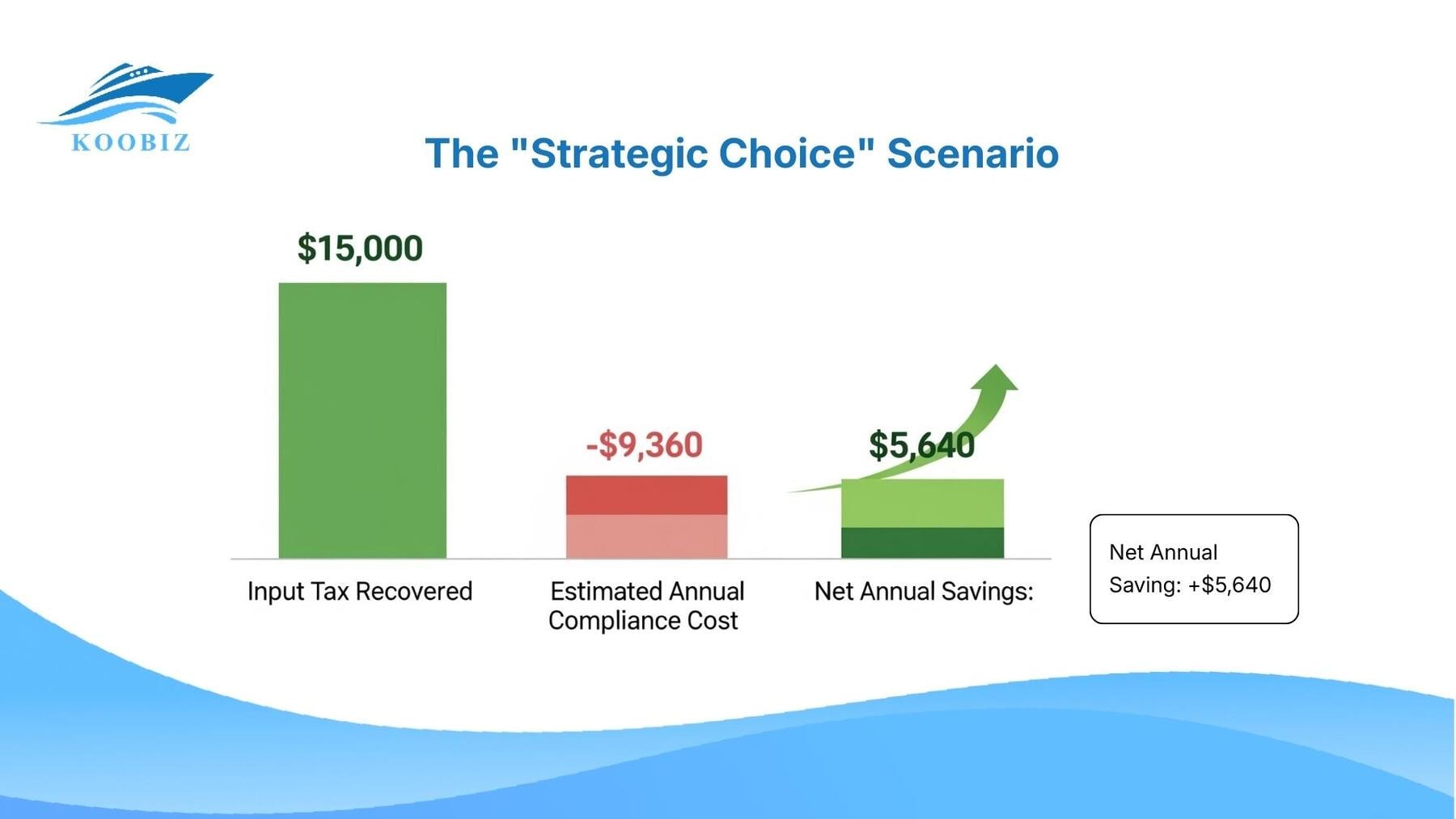

Case 3: The “Strategic Choice” Scenario (Voluntary Registration)

Situation: “CreativeDesign Studio” has a revenue of SGD 400,000. They are renting a fancy office in CBD and paying SGD 8,000 per month + 9% GST. They are not required to register.

- Analysis: They pay SGD 720 in GST every month (SGD 8,640/year) which they currently cannot claim back.

- Decision: They choose Voluntary Registration.

- Net Benefit Calculation:

- Input Tax Recovered: +$8,640

- Estimated Annual Compliance Cost: -$3,000

- Net Annual Savings: +$5,640

- Outcome: It is financially beneficial to register, provided they commit to the 2-year lock-in period and adoption of InvoiceNow.

Special GST Registration Scenarios and Exemptions

Standard rules cover most businesses, but specific scenarios exist for unique models. These exceptions extend the scope of Singapore GST registration requirements to international providers and complex corporate structures.

Applying for Exemption from Registration

Businesses with taxable turnover exceeding SGD 1 million, derived wholly or primarily from zero-rated supplies (e.g., export trading), may apply for an exemption. This spares them from filing returns but also forfeits any input tax claims.

Overseas Vendor Registration (OVR) Regime

The OVR regime mandates GST registration for foreign digital service providers if Global Turnover exceeds SGD 1 million AND Local B2C Supplies exceed SGD 100,000. This ensures a level playing field for the digital economy (e.g., streaming, software). Under this simplified ‘pay-only’ regime, vendors account for GST on B2C supplies but generally cannot claim input tax.

GST Group Registration for Related Companies

Related companies under common control (e.g., >50% shareholding) may register as a single GST entity. This streamlines administration by allowing a consolidated return and disregards intra-group transactions for GST, mitigating related cash flow issues.

Late Registration and Penalties

Failure to register on time can result in fines up to SGD 10,000 and additional penalties (usually 5% of tax due plus 2% per month for continued non-payment). IRAS will backdate the registration, requiring the business to pay all due GST on past sales from its own funds if not collected from customers.

Frequently Asked Questions (FAQ)

What if my taxable turnover is exactly SGD 1 million?

The obligation arises only when turnover exceeds SGD 1 million. However, accounts should be monitored closely.

Can I deregister if my revenue drops below $1 million?

Yes, if the turnover for the next 12 months is expected to be SGD 1 million or less. Voluntary registrants must first complete the 2-year lock-in period.

Does “out-of-scope” supply count towards the $1M threshold?

No. Supplies such as third-country sales or transactions from an overseas branch are excluded from the taxable turnover calculation.

Conclusion

Navigating Singapore GST registration requirements demands a clear understanding of your financial data and future business contracts. Whether you are compelled to register due to the $1 million threshold or are considering voluntary registration for its fiscal benefits, accuracy is paramount. Errors in calculation or delays in application can lead to costly penalties that hinder your business growth.

At Koobiz, we specialize in simplifying corporate services for businesses in Singapore. From company incorporation to opening bank accounts and managing complex tax and accounting frameworks, our team ensures you remain compliant while you focus on expansion.

Disclaimer: This guide is for informational purposes only and does not constitute professional tax advice. Regulations are subject to change; businesses should consult IRAS or a qualified tax advisor for their specific circumstances. Information current as of January 2026.