The Unique Entity Number (UEN) is the universal identification number assigned by the Singapore government to all registered business entities for use in official dealings with government agencies. Understanding this mandatory identification is crucial for compliance. The UEN applies to a vast range of entities, including local companies, Limited Liability Partnerships (LLPs), and registered societies. Whether you are a local entrepreneur or a foreign investor, knowing your entity type determines the specific regulations and requirements you must follow to operate legally within the city-state.

Furthermore, the structure of the UEN itself is not random; it follows specific formats that reveal information about the entity type and year of issuance. Navigating these formats and knowing how to search for them via portals like BizFile+ is a fundamental skill for due diligence and business verification in Singapore’s transparent corporate ecosystem. For entrepreneurs looking to simplify the process of establishing their entity and obtaining this number, securing your UEN is the critical first step. Let’s explore the details below to master everything about the UEN number in Singapore.

What Is a Unique Entity Number (UEN) in Singapore?

The Unique Entity Number (UEN) is the single, standard identification number issued by the Singapore government to all registered business entities to streamline interaction with government agencies. Notably, the UEN is mandatory for any entity that interacts with the government. It replaces the previous ACRA Registration Number and makes the administrative process significantly more efficient. Once issued, this number remains with the entity throughout its lifespan, unless the entity changes its business constitution significantly (e.g., converting from a Sole Proprietorship to a Private Limited Company), in which case a new UEN might be issued.

According to the Accounting and Corporate Regulatory Authority (ACRA), the implementation of UEN has reduced the need for multiple agency-specific numbers, streamlining over 80% of government interactions for businesses.

Which Entities Are Required to Have a UEN?

There are four primary categories of entities legally required to possess a UEN. This requirement ensures that every organization operating within Singapore’s legal framework can be accurately tracked, taxed, and regulated by the relevant authorities.

To illustrate, here is a breakdown of the specific entities that must hold a UEN:

- Businesses and Local Companies: This includes Sole Proprietorships, Partnerships, and Private Limited companies registered with ACRA.

- Limited Liability Partnerships (LLPs): Professional partnerships that combine elements of partnerships and corporations.

- Societies and Non-Profits: Organizations registered with the Registry of Societies (ROS) or Charities under the Ministry of Culture, Community and Youth (MCCY).

- Representative Offices: Foreign entities establishing a temporary presence in Singapore for market research. Note: They are not issued a UEN because they are not legal entities in Singapore.

However, it is important to note who does not need a UEN. Individuals interacting with the government continue to use their NRIC or FIN. Additionally, sub-units or branches of an entity that already has a UEN generally do not get a separate UEN; they utilize the parent entity’s number, sometimes with a branch code extension for internal tracking, though the UEN itself remains the core identifier.

What Do the Different UEN Formats Mean?

UEN formats are structured alphanumeric codes that vary based on the entity type and issuance date. Unlike a random string of numbers, these formats allow anyone reading the number to immediately discern whether the entity is a local company, a business firm, or a specialized body like a trade union.

The table below outlines the three main UEN structures you will encounter:

| Entity Type | Format Structure | Example | Description |

|---|---|---|---|

| Businesses registered with ACRA | nnnnnnnnX | 52812345A | 8 digits followed by 1 check letter (Total 9 chars). |

| Local Companies registered with ACRA | YYYYnnnnnX | 202412345M | Year of incorporation (4 digits) + 5 digits + 1 check letter (Total 10 chars). |

| Other Entities (e.g., LLPs, Societies) | TyyPQnnnnX | T24LL0001A | T: Century (T for 2000s, S for 1900s).

yy: Last 2 digits of year. PQ: Entity type code (e.g., LL for LLP). nnnn: Sequence no. X: Check letter. |

For instance, a Limited Liability Partnership registered in 2024 will follow the “Other Entities” format (T24LL…), whereas a Private Limited Company registered in the same year will typically follow the “Local Companies” format (2024…). This structured approach ensures that despite the growing number of businesses, every entity retains a distinct digital identity.

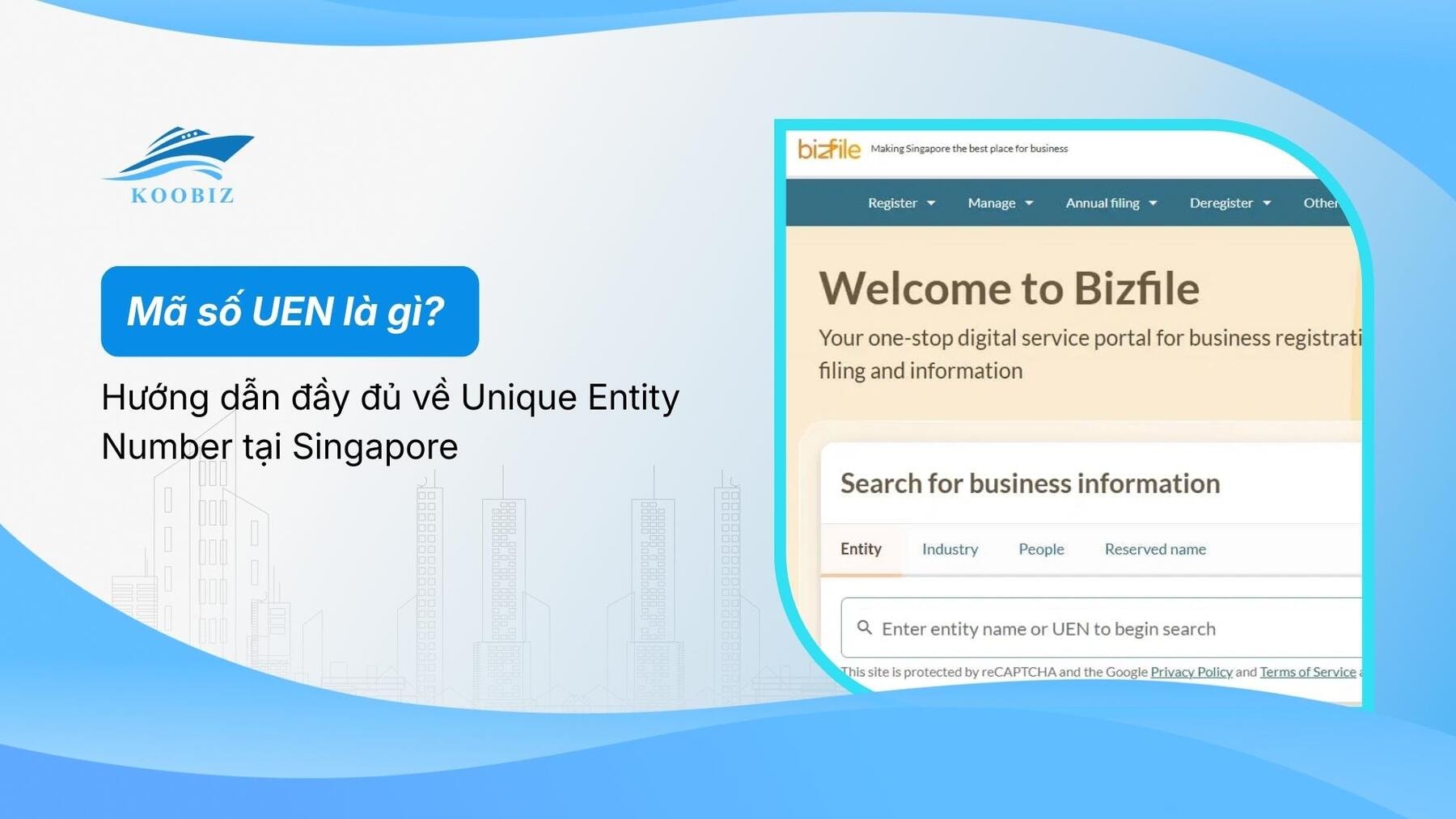

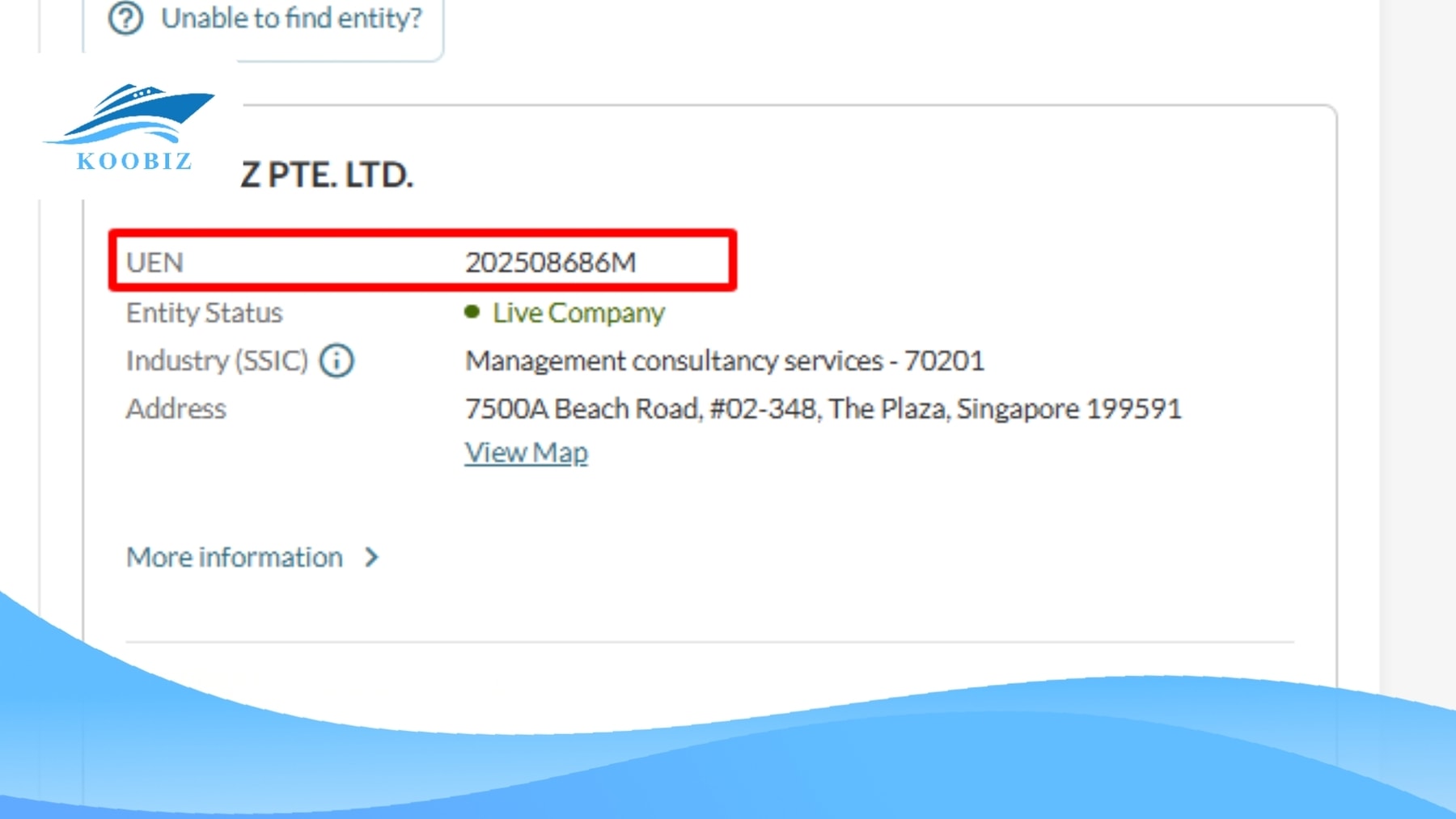

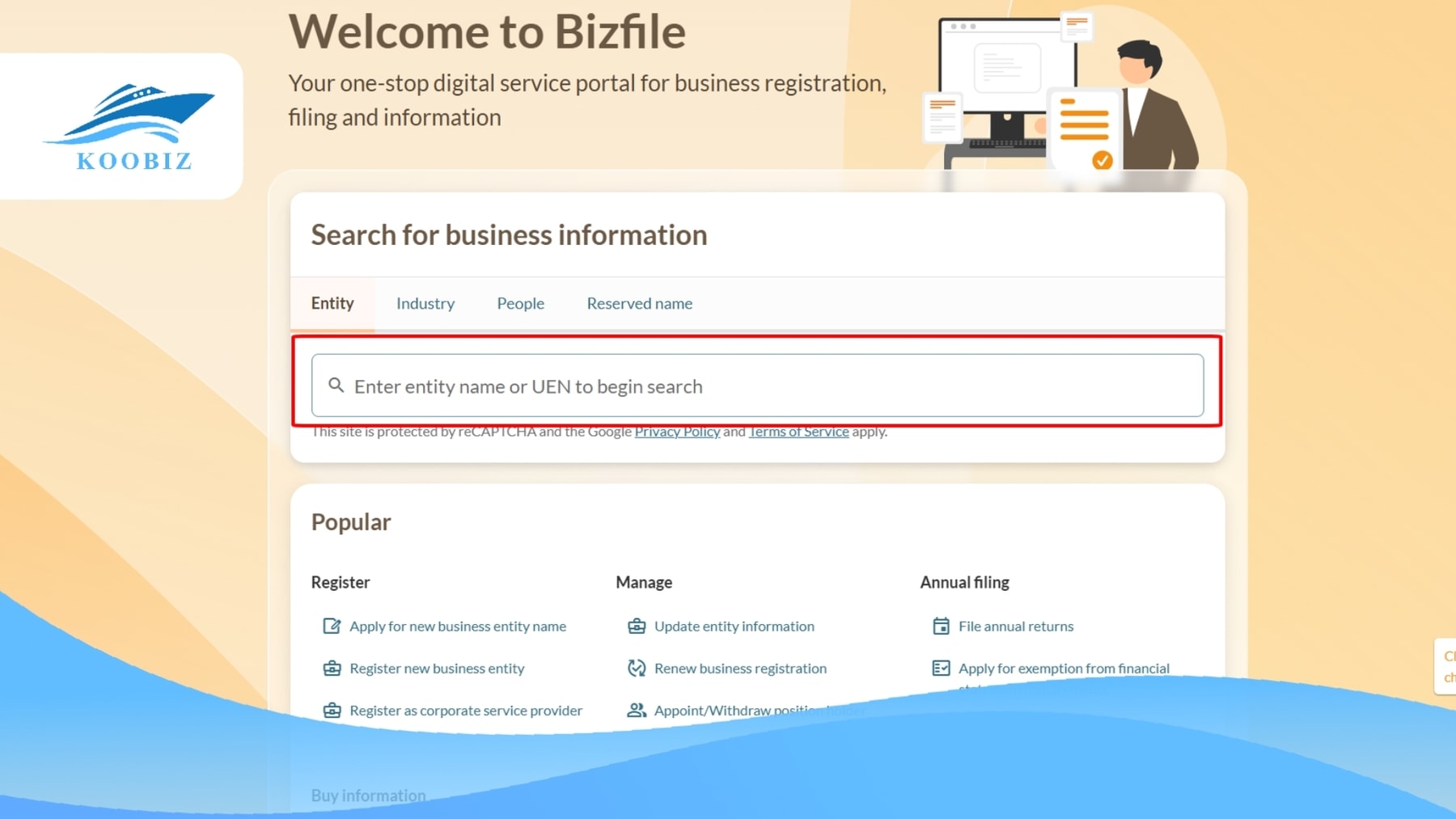

How Can I Search for a Company’s UEN?

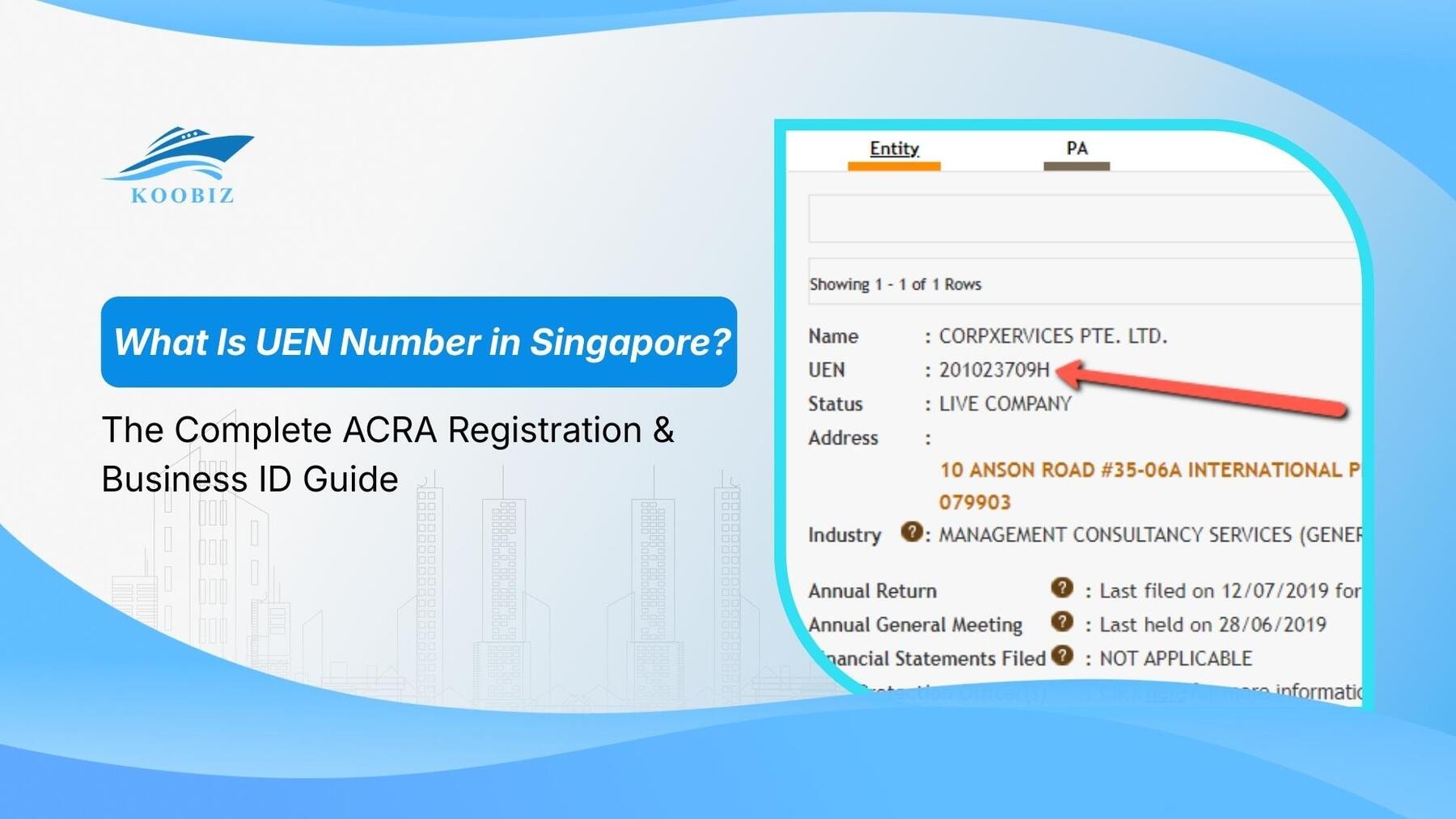

Searching for a company’s UEN is a crucial step in due diligence. You can instantly verify an entity’s registration status and details using the ACRA-managed BizFile+ portal or valid business directories. This public process provides essential information such as the entity’s registered name, status (Live or Struck Off), and address.

To verify a business, follow these steps:

- Visit the Directory: Go to the ACRA BizFile+ website or the official UEN website (uen.gov.sg).

- Enter Information: Type the name of the company or the UEN (if you are verifying the name) into the search bar.

- Analyze Results: The system will display the registered name, UEN, and status.

If you are planning to sign a contract with a partner, checking their UEN status is a mandatory due diligence step. A “Live” status confirms the company is active. If you find the process confusing or need detailed business profiles, Koobiz can assist in retrieving comprehensive business extracts for your potential partners.

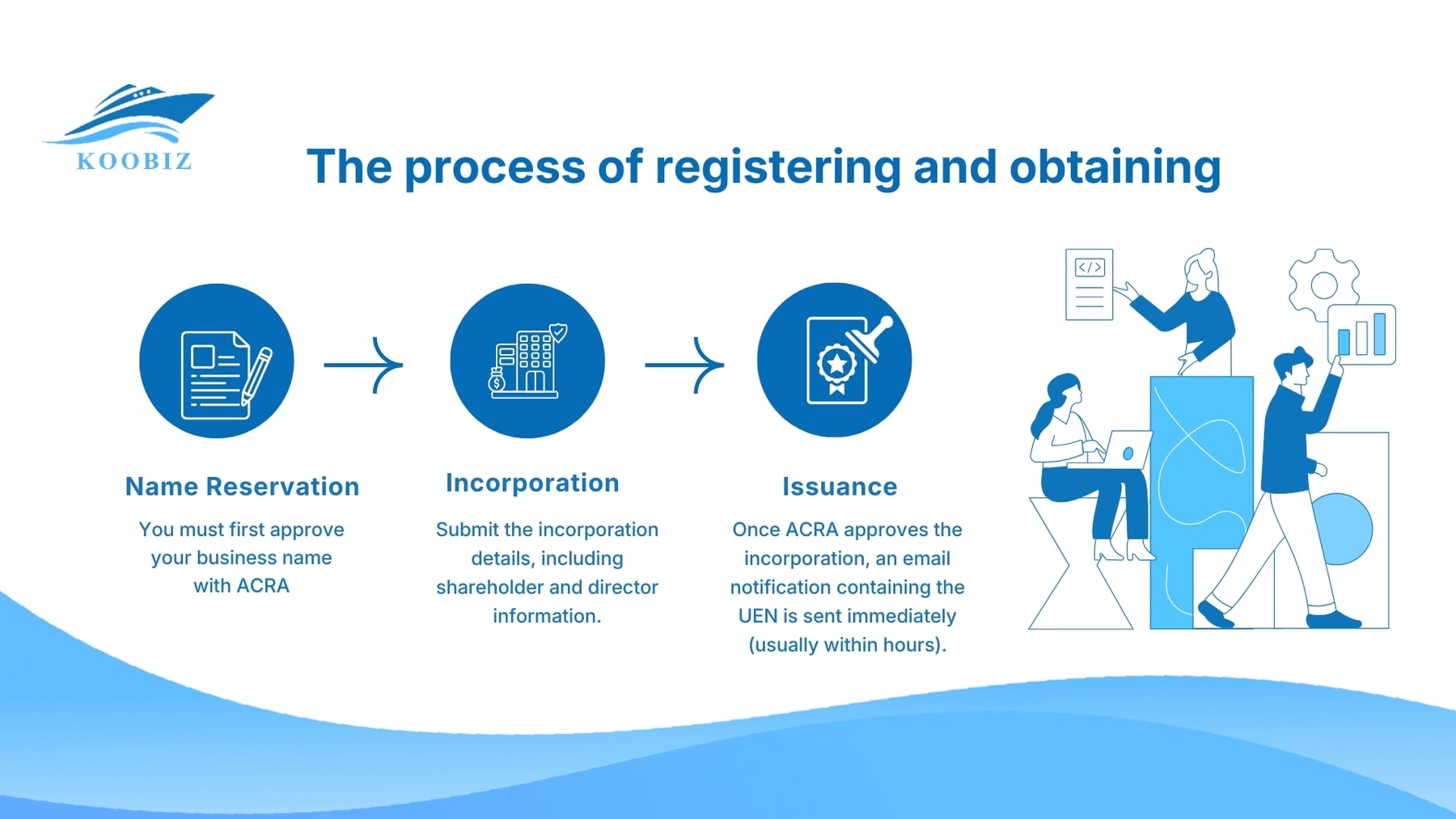

How Do You Register and Obtain a UEN?

Obtaining a UEN involves registering your business entity with ACRA or the relevant issuance agency. The UEN is automatically generated upon successful incorporation; there is no separate application form. It is an inherent outcome of the entity formation process.

For most commercial entities like Private Limited companies, the process is handled via ACRA:

- Name Reservation: You must first approve your business name with ACRA.

- Incorporation: Submit the incorporation details, including shareholder and director information.

- Issuance: Once ACRA approves the incorporation, an email notification containing the UEN is sent immediately (usually within hours).

For other entities, such as societies, the UEN is issued after approval by the Registry of Societies. Navigating the incorporation requirements can be complex for new entrepreneurs. Koobiz specializes in streamlining this process. When you choose our incorporation package, we handle all ACRA liaising, ensuring your UEN is issued correctly and quickly, so you can open your corporate bank account without delay.

Ready to start your business in Singapore? Contact Koobiz today for a seamless incorporation experience and get your UEN fast!

Can You Customise Your Business ID with Special UEN (SUN)?

Yes, businesses can customize their ID through the Special UEN (SUN) service by paying a fee to select a preferred number from reserved tiers. Similar to buying a “golden” mobile number or car plate, ACRA allows business owners to choose a UEN that is easy to remember or holds auspicious value.

Specifically, there are two tiers available during the registration process:

- Tier 1 ($3,000): These are numbers with consecutive identical digits or specific patterns (e.g., ending in 8888, 12345).

- Tier 2 ($1,000): These numbers have repetitive patterns but are less exclusive than Tier 1 (e.g., ending in 88, 66, or repetitive pairs like 2323).

While not mandatory, investing in a Special UEN can be beneficial for branding, making it easier for clients and partners to recall your business ID for PayNow transactions or invoicing.

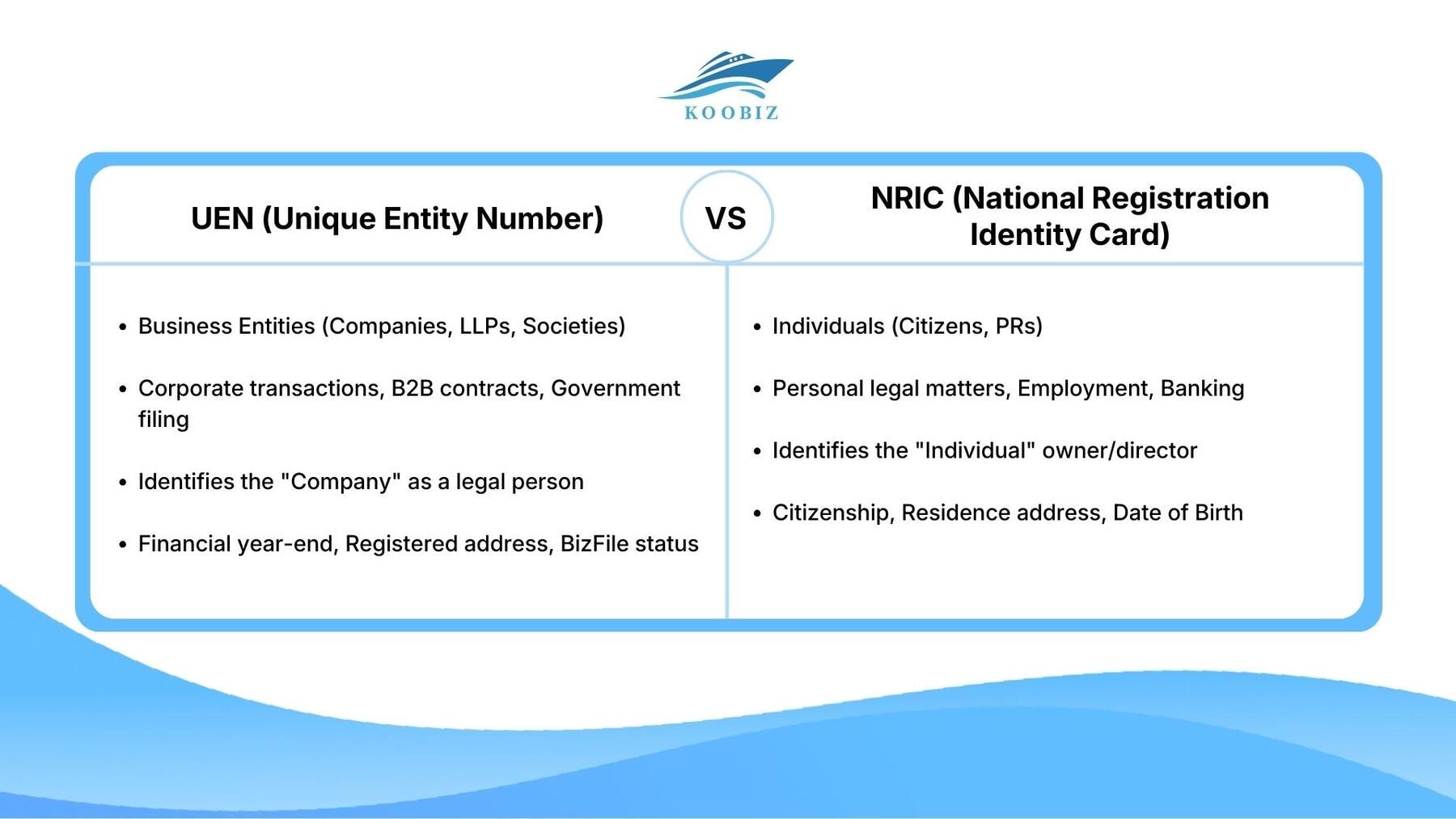

What Is the Difference Between UEN and NRIC?

The UEN identifies business entities for corporate transactions, whereas the NRIC (or FIN) identifies individuals for personal legal matters within Singapore. This distinction is vital because a business is a separate legal person from its owner, and confusing the two can lead to invalid contracts.

| Feature | UEN (Unique Entity Number) | NRIC (National Registration Identity Card) |

|---|---|---|

| Target Identity | Business Entities (Companies, LLPs, Societies) | Individuals (Citizens, PRs) |

| Primary Use | Corporate transactions, B2B contracts, Government filing | Personal legal matters, Employment, Banking |

| Legal Status | Identifies the “Company” as a legal person | Identifies the “Individual” owner/director |

| Data Tracked | Financial year-end, Registered address, BizFile status | Citizenship, Residence address, Date of Birth |

To illustrate, when you sign a contract for your company, you enter the company’s UEN, not your personal NRIC. The NRIC tracks personal data like citizenship and residence, while the UEN tracks corporate data.

What Is the Difference Between UEN and GST Registration Number?

The UEN is the mandatory business ID for all, while the GST Registration Number is usually the same UEN but specifically activated for tax collection when revenue exceeds $1 million.

It is important to understand that simply having a UEN does not mean you are GST-registered. You must apply for GST registration separately with IRAS. Once registered, your UEN typically serves as your GST identifier. You will then be required to print “GST Reg No: [Your UEN]” on all tax invoices.

While most local companies use their UEN as their GST number, distinct entities (like joint ventures or GST groups) may be issued a separate GST group registration number. However, for 99% of SMEs, they are identical identifiers with different functional statuses.

Where Must the UEN Be Displayed on Official Documents?

The UEN must be displayed on all official correspondence, including invoices, receipts, brochures, and websites, to comply with the Companies Act. Failure to display this number can result in penalties, as it denies stakeholders the ability to verify the entity they are dealing with.

You must include the UEN on:

- Business Letters and Statements of Account.

- Invoices and Official Receipts.

- Notices and Publications (including websites and email signatures).

- Bills of Exchange and Promissory Notes.

Ensuring your Koobiz incorporated company complies with these disclosure requirements is part of building a trustworthy brand reputation in Singapore.

Frequently Asked Questions (FAQ)

Is the UEN number the same as the Tax Identification Number (TIN)?

Yes, in Singapore, the UEN serves as the Tax Identification Number (TIN) for corporate entities when dealing with the Inland Revenue Authority of Singapore (IRAS).

Do I need to renew my UEN?

For local companies (Pte Ltd) and LLPs, the UEN is permanent and does not need renewal as long as the entity exists. However, for Sole Proprietorships and Partnerships, you must renew your business registration periodically to keep your UEN active.

Is applying for a UEN free?

The UEN itself is issued automatically upon registration. The cost involved is the registration or incorporation fee paid to ACRA (e.g., $315 for a Private Limited Company). If you opt for a Special UEN (SUN), additional fees apply.

Simplify Your Singapore Incorporation with Koobiz

Understanding the UEN is just the first step in establishing a successful business in Singapore. Navigating the full spectrum of ACRA regulations, from initial name reservation to final UEN issuance and tax compliance, requires expertise and precision.

Koobiz is your trusted partner for seamless company incorporation in Singapore. We move beyond simple registration; we provide a comprehensive suite of corporate services designed to get your business operational quickly. With our expert guidance, you can secure your UEN, open your corporate bank account, and ensure full compliance without the administrative headache.

Ready to launch your business? Visit koobiz.com today to start your incorporation journey!