Tax season can feel overwhelming when you’re your own boss. Unlike salaried employees whose taxes are handled automatically, knowing how to file income tax for self-employed Singapore is your responsibility. But it doesn’t have to be confusing.

This guide focuses on Year of Assessment (YA) 2026, covering income earned from 1 Jan 2025 to 31 Dec 2025.

At Koobiz, we simplify this process. We’ll walk you through the entire process in plain English, from logging in to getting your tax bill, so you can file with confidence and keep more of your hard-earned money.

Who is Considered Self-Employed?

A self-employed person is defined as any individual who operates a trade, business, profession, or vocation, earning a living on their own account rather than as an employee.

To clarify this classification further, IRAS considers you self-employed if you earn income by providing services or selling goods independently. This broad category encompasses freelancers, sole proprietors, commission agents (like real estate or insurance agents), and gig economy workers (such as delivery riders and private hire drivers). If you are not under a contract of service (employment contract) but rather a contract for service, you fall into this category. In short: if you invoice clients, get paid per project, or run your own show, you’re likely self-employed for tax purposes.

When Must You File Your Taxes?

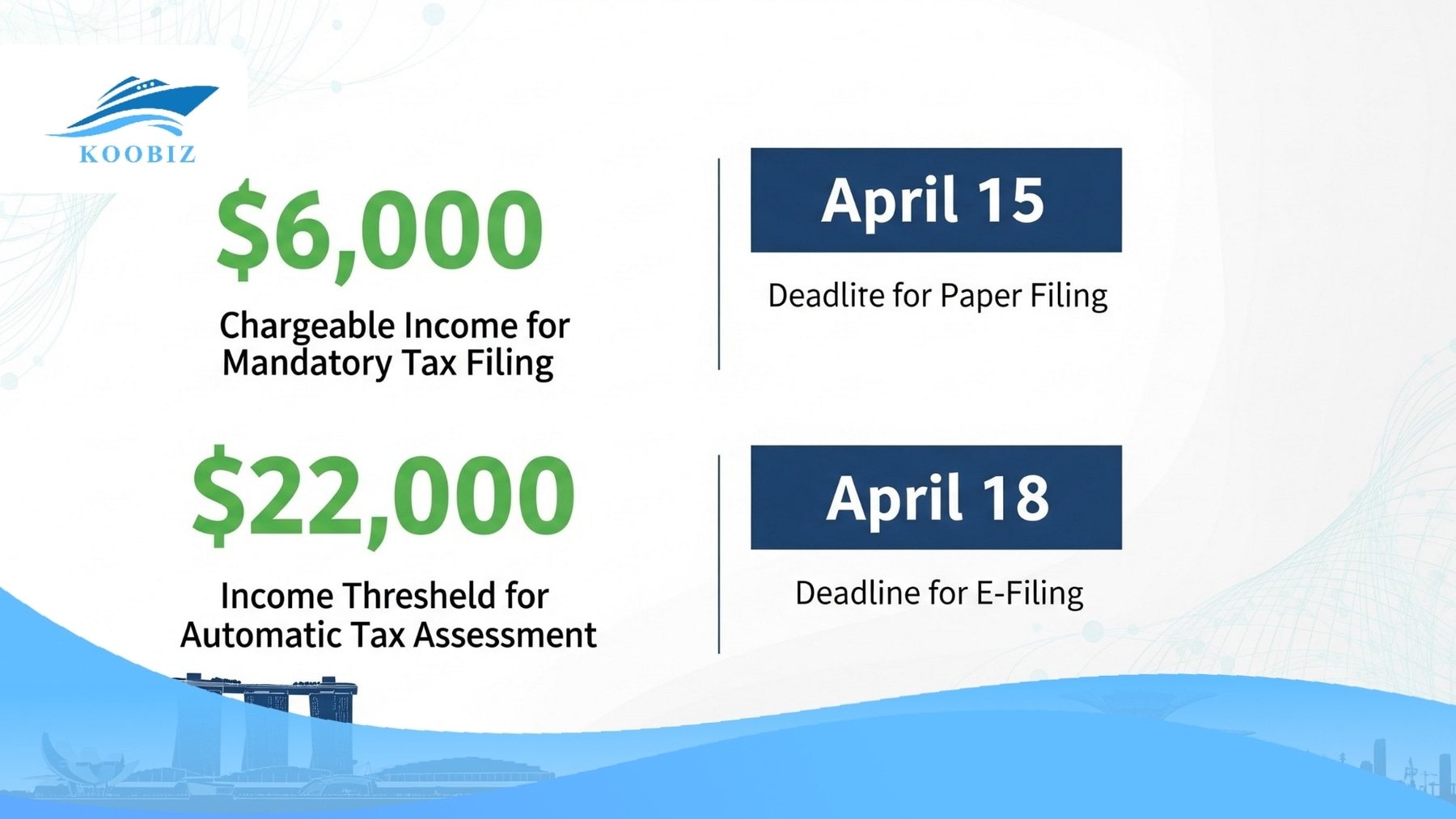

You are legally required to file an Income Tax Return if your Net Trade Income exceeds $6,000 or your Total Income surpasses $22,000 annually.

For YA 2026 (income earned in 2025), you must file an Income Tax Return if you meet either of the following conditions:

- Net Trade Income > $6,000: Your revenue minus allowable business expenses is more than $6,000.

- Total Income > $22,000: Your combined income (trade income + employment income + rental income, etc.) exceeds $22,000.

Critical Deadlines:

Missing a deadline can result in penalties. Mark these dates on your calendar:

- April 15: Deadline for paper filing (Form B sent by mail).

- April 18: Deadline for e-filing via the myTax Portal.

According to recent data from IRAS, over 90% of taxpayers now choose e-filing due to the extended deadline and the convenience of instant acknowledgement.

Step-by-Step Guide: How to File Income Tax via myTax Portal

Filing involves three main steps via the myTax Portal: logging in with Singpass, declaring trade income, and receiving the acknowledgement.

Filing online is straightforward. Just follow these three steps.

Before You Start: Have your Singpass login details ready, along with a simple summary of your 2025 business income and expenses.

Step 1: Access and Verification

Log in to myTax Portal using your Singpass. Once inside, navigate to “Individuals” > “File Income Tax Return”. The system will display your personal particulars. Verify that your mobile number and email address are updated so you can receive alerts regarding your Notice of Assessment (NOA).

Step 2: Declaring Trade Income

This is the core of the process for how to file income tax for self-employed Singapore.

- Select “Trade, Business, Profession or Vocation”.

- You will be prompted to enter your Revenue (Total sales/income) and Gross Profit/Net Profit.

- If you participated in the Pre-filling of Income scheme (common for Grab/Gojek drivers and delivery riders), your income information might already be populated by the platform operator. In this case, you simply need to verify the figures. If the pre-filled data is incorrect, you must amend it to reflect your actual earnings.

Step 3: Confirmation and Acknowledgement

After entering all financial data and claiming relevant reliefs, review your declaration on the summary page. Ensure no income sources are omitted. Click “Submit”. You will see an acknowledgement page with a reference number. Save or print this page as proof of submission.

Pro Tip from Koobiz: Always keep a digital copy of your submission receipt. In the rare event of a system dispute, this receipt is your primary evidence of timely filing.

Form B vs. Form B1: Which Tax Form Should You Choose?

Self-employed individuals typically use Form B, but form assignment depends on your specific income profile.

How to be 100% sure: The safest way is to simply log into your myTax Portal. The system will automatically show you the form (B or B1) that you need to fill out. Just use the one assigned to you.

- Form B: The go-to form for freelancers, sole proprietors, and partners.

- Form B1: Sometimes assigned by IRAS. If you are a partner in a firm, your managing partner must file first before you can complete your Form B1.

Disclaimer: Always log in to the myTax Portal to check which form IRAS has assigned to you.

| Criteria | Form B | Form B1 |

|---|---|---|

| Primary Audience | Self-Employed, Sole Proprietors, Partners | Tax Resident Individuals |

| Income Covered | Trade Income + Employment + Rental | Employment + Other Income |

| Typical Use | Standard form for declaring business/trade income. | Often used by employees, but can be assigned to others. |

| Prerequisite | None (File directly) | Precedent Partner must file Form P first (if you are a partner) |

Form B (The Standard): This is the most common form for freelancers and business owners. It is comprehensive and allows you to declare trade income alongside any other personal income (like rental or employment income).

Note for Partners: If you are a partner in a partnership (or LLP), the Precedent Partner must first file Form P to determine the partnership’s divisible profit. Once that is done, you report your specific share of the profit in your own Form B (or B1, if assigned).

2-Line Statement vs. 4-Line Statement: Declaring Your Revenue

The 2-Line Statement is for revenue under $200,000, while the 4-Line Statement requires a detailed breakdown for revenue exceeding $200,000.

IRAS has two ways to report, based on how much you earned.

Is your annual revenue more than $200,000?

- NO (< $200,000) → Use 2-Line Statement

- Simplicity: High (Simplified filing process).

- What to Report: Just 2 figures: Revenue (Total Turnover) and Net Business Income (Revenue minus Expenses).

- Record Keeping: You must still keep physical receipts for 5 years, even though you don’t enter the expense details online.

- YES (≥ $200,000) → Use 4-Line Statement

- Simplicity: Low (Requires detailed breakdown).

- What to Report: 4 specific figures:

- Revenue

- Gross Profit (Revenue minus Cost of Goods Sold)

- Allowable Business Expenses

- Net Profit/Loss

Understanding this helps you prepare your bookkeeping. At Koobiz, we often see clients with revenue just above the $200k mark struggling to convert their simple records into the 4-line format. Proper bookkeeping throughout the year is essential to make this step seamless.

Essential Tax Deductions and Reliefs for Freelancers

Freelancers can claim deductions through allowable business expenses, capital allowances, and personal reliefs like CPF and Earned Income Relief.

This section is where thoughtful planning can notably cut your tax burden. Deductions aren’t “loopholes”; they’re legitimate provisions designed to tax you only on your profit, not your revenue. To help you file accurately, use this checklist:

Allowable Business Expenses (Deductible)

- The Golden Rule: To be deductible, an expense must be “wholly and exclusively” incurred in the production of your income.

- Operating Costs: Office rental, utility bills for the office, and business phone bills.

- Marketing: Website hosting, advertising ads, and domain names.

- Professional Fees: Accounting fees (like those paid to Koobiz), legal fees for trade disputes.

- Transport: Public transport costs incurred strictly for business meetings (traveling from home to office is not deductible).

Capital Allowances (Assets)

- Items: Fixed assets like laptops, cameras, and office furniture.

- Rule: You cannot claim the purchase cost as a direct expense. Instead, you claim Capital Allowances. Under the simplified tax regime, low-value assets (costing not more than $5,000 each) can often be written off in one year (100% write-off), subject to a total claim cap of $30,000 per year of assessment.

Strictly Non-Deductible

- Private Car Expenses: Petrol, parking, and ERP are never deductible, even if the car is used for business purposes.

- Personal Expenses: Private meals, entertainment, or travel costs not wholly related to the business.

CPF Reliefs (Personal)

- Medisave: Compulsory Medisave contributions are tax-deductible.

- CPF Cash Top-Ups: You can claim tax relief for voluntary cash top-ups to your CPF Special/Retirement Account (under the RSTU Scheme). The cap is up to $16,000 per year (maximum $8,000 for yourself + maximum $8,000 for parents/spouse/siblings).

Under IRAS guidelines, the most common source of confusion is correctly distinguishing between “Revenue Expenses” (deductible right away) and “Capital Expenses” (eligible for allowances).

Common Mistakes and Penalties to Avoid

Common errors include under-declaring income and claiming personal expenses, which can lead to penalties ranging from 100% to 400% of tax undercharged.

Moving from the practical steps of filing to strict compliance is equally important for safeguarding your finances. The boundary between a genuine error and tax evasion hinges on intent, but both carry consequences.

| Violation | Example | Potential Penalty |

|---|---|---|

| Under-Declaration | Omitting cash income, ad-hoc projects, or “off-the-books” jobs. | Up to 200% of tax undercharged (Negligence) |

| False Expense Claims | Claiming private meals as “entertainment” or 100% of home electricity. | Disallowance of claim + Fines |

| Tax Evasion | Willfully falsifying records or omitting income with intent to evade. | Up to 400% of tax undercharged + Jail Term |

How to Fix Mistakes (Voluntary Disclosure):

If you realize you have made an error, you should use the Voluntary Disclosure Programme (VDP). IRAS may reduce or waive penalties if you come forward voluntarily before they commence an audit or investigation.

How to Handle Business Losses and Capital Allowances

Business losses can be carried forward to offset future profits, or carried back to the immediate preceding year under specific conditions.

Business isn’t always profitable. If your allowable expenses exceed your revenue, you have a trade loss.

- Loss Carry-Forward: You can carry forward unused trade losses and capital allowances to offset future-year income. This typically requires no substantial change in the business’s shareholders or owners (a condition less relevant for sole proprietors, but important for partnerships).

- Loss Carry-Back: Under the Loss Carry-Back Relief scheme, you can apply current-year unabsorbed capital allowances and trade losses to offset assessable income in the immediately preceding Year of Assessment (YA), up to a cap of $100,000. This can result in a cash flow refund when you need it most.

Record Keeping Requirements: The 5-Year Rule

The 5-Year Rule mandates that self-employed individuals must retain all proper records and receipts for a period of five years.

Even after you receive your Notice of Assessment (tax bill), the work isn’t over for your receipts. IRAS conducts random audits, and if you’re selected, you’ll need to produce invoices, receipts, and vouchers to substantiate your 2-Line or 4-Line statement.

What to keep:

- Invoices issued to customers.

- Receipts for business expenses (ink on thermal receipts fades, so scan/digitize them!).

- Bank statements separating business and personal transactions.

Failing to provide records when requested can lead IRAS to disallow your expense claims (raising your tax) and to fines for poor record-keeping.

Payment Options: Using GIRO for Installments

Taxpayers can pay via GIRO for up to 12 interest-free monthly installments or use electronic payment modes like PayNow and AXS.

After you file, managing cash flow for the tax payment becomes the next challenge. A lump-sum tax bill can be heavy for a freelancer.

- GIRO: This is the most recommended method. By enrolling in GIRO, IRAS lets you split your tax payment into up to 12 interest-free monthly installments, which helps you manage liquidity.

- Electronic Payment: If you prefer one-off payments, PayNow QR or AXS stations are available. Note that late payment attracts a 5% penalty.

What If You Make a Mistake?

If an error occurs, you must file an objection via the ‘Object to Assessment’ digital service within 30 days of the NOA date.

We are all human, and errors in data entry happen. If you realize you declared $50,000 instead of $5,000, or forgot to claim a major relief:

- Do not panic.

- Log in to the myTax Portal.

- Use the “Object to Assessment” service.

- State the specific revisions required.

You must do this strictly within 30 days of receiving your tax bill. If the window passes, the assessment becomes final and conclusive.

Conclusion

Filing income tax for self-employed individuals in Singapore requires careful attention—choosing the correct Form B and distinguishing between the 2-Line and 4-Line statements. While the myTax Portal streamlines the process, the real value comes from understanding the tax framework well enough to claim every deduction you’re entitled to while remaining fully compliant with IRAS regulations.

At Koobiz, we specialize in supporting entrepreneurs and freelancers with their corporate and financial needs in Singapore. Whether you need assistance with company incorporation, opening a corporate bank account, or require professional tax and accounting services to ensure your filings are flawless, our team is ready to assist. Don’t let tax season disrupt your business growth.

Visit Koobiz.com today to streamline your business administration and focus on what you do best.