In 2026, Singapore’s regulatory regime remains strict, with ACRA enforcing firm deadlines for Annual Return and XBRL filings. For directors, meeting these timelines is not merely administrative – it is essential to avoid penalties and preserve a strong compliance record. Whether you operate a Private Limited Company or a Solvent EPC, missed deadlines can result in substantial financial consequences.

At Koobiz, we’ve prepared this practical guide to help you determine your exact filing deadline, understand applicable fines, and assess available exemptions.

Is XBRL filing mandatory for Singapore Companies in 2026?

Yes. In 2026, most Singapore-incorporated companies are required to file financial statements in XBRL format unless they qualify for a specific exemption. ACRA mandates XBRL to enhance transparency and enable efficient financial analysis.

This requirement applies to both unlimited and limited-by-shares companies. If your company is insolvent or does not qualify as a Solvent Exempt Private Company (EPC), a full set of XBRL financial statements must be lodged via ACRA BizFile+ portal. Even where the FYE falls in late 2025, the filing obligation typically arises in 2026. Failure to submit the correct XBRL file with the Annual Return will result in immediate rejection and non-compliance.

2026 XBRL Filing Schedule: Deadlines Based on FYE

In 2026, Annual Return filing deadlines (including XBRL) fall into two separate timelines, depending on whether the company is listed or non-listed.

To avoid missing the deadline, directors must determine the filing date based on the company’s Financial Year End (FYE), applying the standard rule that combines the permitted AGM period with the statutory filing window.

| Company Type | AGM Deadline (from FYE) | Annual Return Deadline (from FYE) | Example (FYE 31 Dec 2025) |

|---|---|---|---|

| Private Limited (Non-listed) | 6 months | 7 months | AGM by 30 Jun 2026

File by 30 Jul 2026 |

| Listed Company | 4 months | 5 months | AGM by 30 Apr 2026

File by 30 May 2026 |

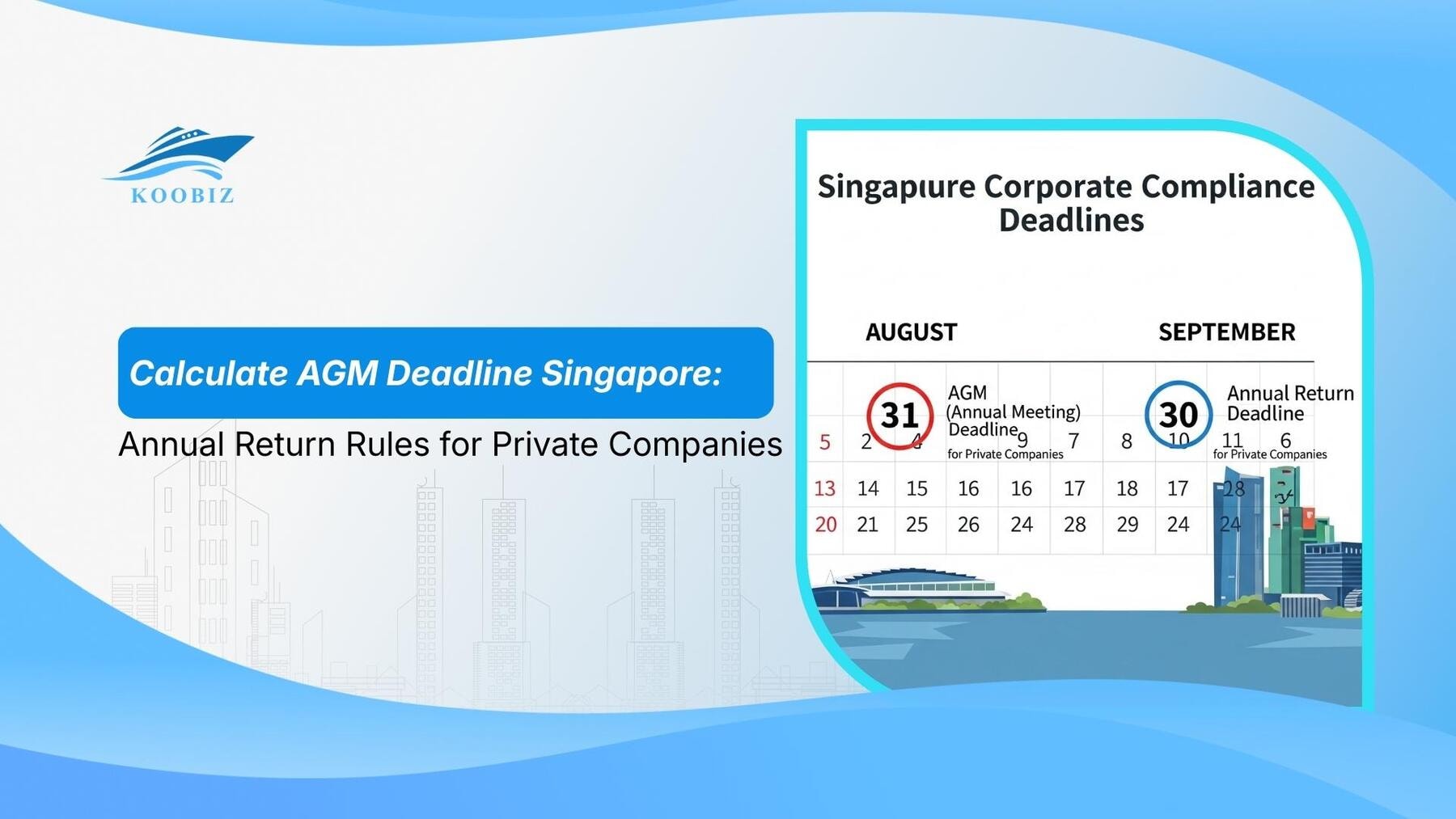

Private Limited Companies: The 7-Month Rule Explained

Private Limited Companies must complete their Annual Return filing within 7 months from the Financial Year End. This period covers two statutory steps: holding the AGM within 6 months of the FYE, followed by filing the Annual Return (including XBRL) within 30 days after the AGM.

For instance, with an FYE of 31 December 2025, the AGM must be held by 30 June 2026, and the final filing deadline falls on 30 July 2026. Koobiz recommends preparing the XBRL conversion at least one month before the AGM to ensure accuracy ahead of directors’ approval.

Listed Companies: Stricter timelines for 2026

Listed companies in Singapore operate under a shorter timeline, with only 5 months from the Financial Year End to complete their filings. They must hold the AGM within 4 months of the FYE and lodge the Annual Return, including XBRL, within 30 days thereafter.

For example, with an FYE of 31 December 2025, the AGM must be held by 30 April 2026 and the XBRL filing completed by 30 May 2026. This compressed timeline requires efficient reporting processes to meet the heightened compliance expectations of public entities.

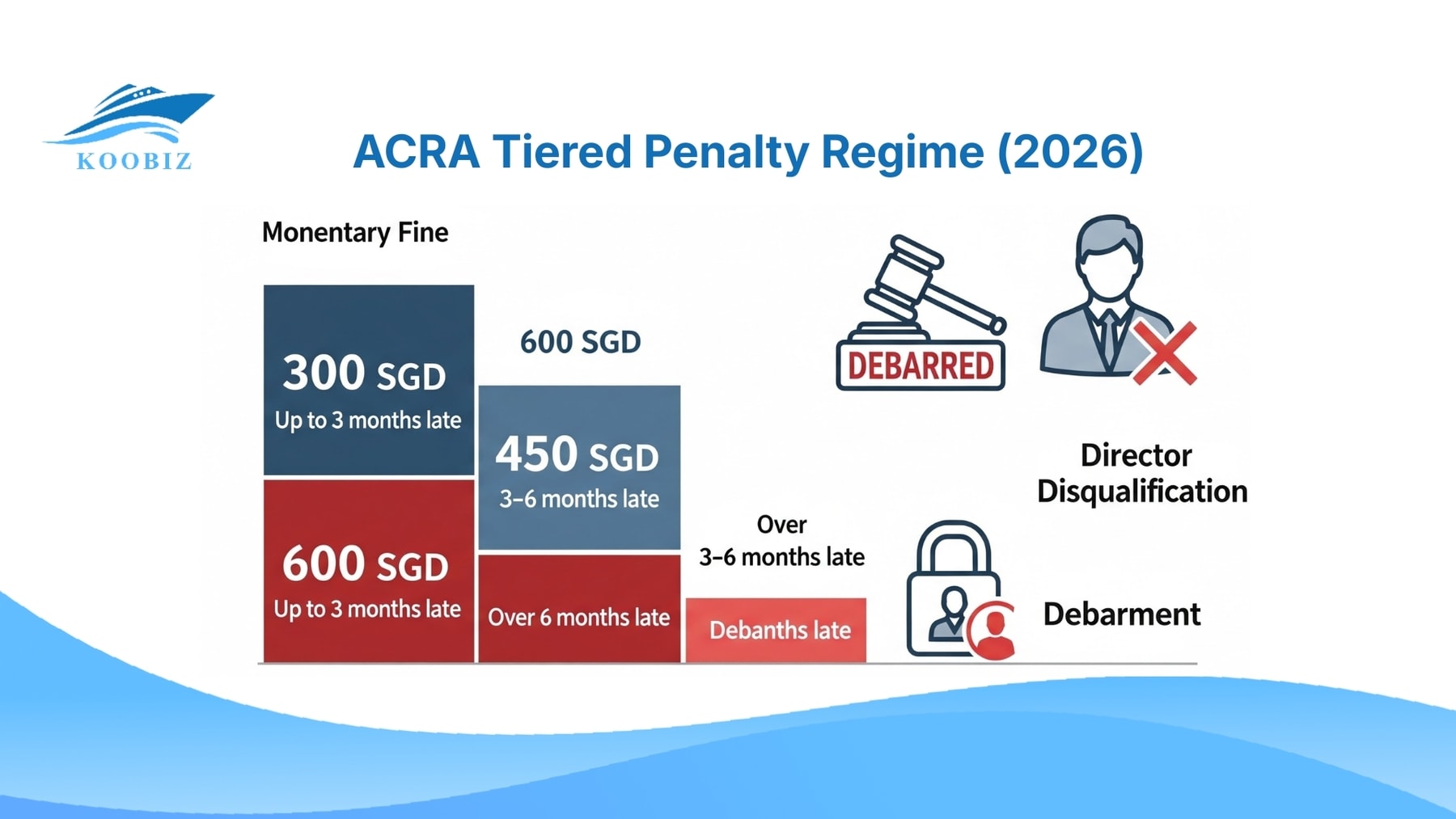

Updated ACRA penalties for late lodgment in 2026

In 2026, ACRA enforces a tiered penalty regime for late filings, ranging from monetary fines to serious administrative sanctions on directors. While an initial late fee may appear minor, repeated non-compliance can severely damage a company’s compliance record and reputation. Notably, these penalties are automatically triggered by the BizFile+ system upon late submission.

How late fees accumulate: Tiered penalty Structure

Late lodgment fees are capped based on the length of the delay, typically ranging from $300 to $600 per statutory breach. Filing the Annual Return within three months of the deadline usually incurs a $300 penalty, increasing to $600 if the delay exceeds three months.

Importantly, penalties are imposed separately for the AGM and the Annual Return. Missing both deadlines can therefore double the total fines – an avoidable cost that services like Koobiz help mitigate through proactive compliance reminders.

Directors’ Liability: Can you be disqualified?

Yes. Directors may be disqualified or debarred for persistent breaches of the Companies Act. Under the enhanced enforcement regime, a director with three or more companies struck off by ACRA within five years may be barred from holding directorships. In addition, ACRA now displays a public compliance rating on the Business Profile, meaning repeated late XBRL filings can directly undermine a company’s credibility with banks and investors.

Real-World Scenarios: 2026 compliance in action

To put these deadlines into perspective, the following three scenarios for the 2025/2026 financial year show how the rules apply across different business structures and the real cost of missing them.

Scenario 1: The Standard Private Company

Company Profile: TechStart Pte. Ltd. (Private Company)

- FYE: 31 December 2025.

- Deadline Calculation:

- AGM: Must be held by 30 June 2026 (within 6 months).

- Filing: Must file Annual Return by 30 July 2026 (within 7 months).

- Outcome: The director approves the Financial Statements in June, and the Corporate Secretary files the XBRL via BizFile+ in July. The company remains compliant with zero penalties.

Scenario 2: The Listed Entity

Company Profile: Global Trade Holdings Ltd (Public Listed)

- FYE: 31 March 2026.

- Deadline Calculation:

- AGM: Must be held by 31 July 2026 (within 4 months).

- Filing: Must file Annual Return by 31 August 2026 (within 5 months).

- Outcome: Due to the tighter timeline, the company completes its audit by early July to meet the accelerated deadline.

Scenario 3: The Cost of Delay

Company Profile: LateBloomer Services Pte. Ltd.

- FYE: 31 December 2025.

- Filing Date: The company misses the 30 July 2026 deadline and finally files on 15 November 2026 (3.5 months late).

- Consequence:

- Late Lodgment Fee: $600 (imposed immediately because the delay exceeded 3 months).

- Composition Sum: ACRA may also offer a separate composition sum (minimum $500) for the breach of Section 197 (Annual Return) or Section 175 (AGM).

- Total Risk: The company faces a potential total of $1,100+ in fines and a permanent “Late” remark on the director’s compliance history for that year.

With the key deadlines and penalties established, we now turn to the finer details of the filing requirements. Not all companies are subject to the same obligations, and understanding the applicable exemptions and variations can save substantial time and resources in 2026.

Understanding Revisions: Revised XBRL Requirements in 2026

The Revised XBRL Filing Requirements are now the authoritative standard for financial reporting in Singapore. Designed to streamline data elements, this framework reduces compliance burden while still capturing the key financial information required by ACRA.

To navigate these requirements effectively in 2026, directors should note the following key changes:

- Elimination of Old Options: Companies are no longer permitted to use the obsolete “Option A” or “Option B” formats, which have been fully phased out.

- The Single Template Approach: Most companies must now file using the Revised XBRL Filing Requirements template. This unified template focuses on capturing approximately 100+ data elements that allow ACRA to benchmark industry performance.

- Simplified vs. Full IFRS: While less exhaustive than the full IFRS taxonomy, the revised template still requires precise mapping of financial line items to ensure accuracy.

Understanding these specific data entry points is where the professional corporate secretaries at Koobiz add immense value, ensuring your financial mapping complies strictly with the latest taxonomy revisions.

Exemptions and Special Cases for 2026 Filing

Certain categories of companies are exempted from filing a full set of XBRL financial statements based on their solvency or level of activity. Determining whether your entity falls within these “unique” or “rare” classifications is key to optimizing your compliance approach.

Solvent EPCs: Do you need to convert financials to XBRL?

No. Solvent Exempt Private Companies (EPCs) are not required to file financial statements in XBRL, provided they make the necessary solvency declarations. An EPC is a private company with no more than 20 shareholders and no corporate shareholders. If solvent, it may file a simplified Annual Return without financial statements or attach them in PDF format. While XBRL filing is optional, voluntary submission may enhance the company’s credit profile. By contrast, insolvent EPCs must file a full set of XBRL financial statements.

Filing for dormant companies: Simplified process

Dormant companies enjoy a much simpler filing regime than active entities. A company is considered dormant if it has no accounting transactions during the financial year. In 2026, a dormant non-listed company that meets the substantial assets test (total assets ≤ S$500,000) is exempt from preparing financial statements and filing XBRL.

Such companies may submit a simplified Annual Return via BizFile+ to confirm their dormant status. While this exemption can significantly reduce compliance costs, directors must ensure no unintended transactions (such as bank charges) have occurred that would negate dormancy.

What to Do If You Miss the 2026 Deadline?

If your company is unable to meet the XBRL filing deadline, the appropriate step is to apply for an Extension of Time (EOT) instead of filing late. Proactive action signals to ACRA that the board is managing the issue responsibly.

Step-by-Step Guide to Applying for an Extension of Time (EOT)

Applying for an EOT involves a formal request via the BizFile+ portal, which must be submitted before the statutory deadline expires.

- Log in to BizFile+: Use your Corppass to access the portal at www.bizfile.gov.sg.

- Select EOT Service: Navigate to “Annual Filing” and select “Application for Extension of Time for Holding AGM/Filing AR”.

- Provide Justification: You must state a valid reason (e.g., delay in audit, change of financial year).

- Pay the Fee: The fee is $200 per application (covering up to 60 days extension).

Approvals are generally granted if the application is made early. However, relying on EOTs annually is not sustainable. For a long-term solution, partnering with a corporate service provider like Koobiz ensures that your accounts are prepared and converted to XBRL well ahead of schedule, keeping your company in good standing.

Frequently Asked Questions (FAQ)

Can I file my XBRL after the AGM date?

Yes, the Annual Return (which includes the XBRL) is typically filed after the AGM. You have 30 days after the AGM to complete this filing.

What if I have zero income but expenses? Am I dormant?

Not necessarily. If you have administrative expenses (like paying a secretary or audit fees), the company may be considered “active” for filing purposes. Dormancy usually requires no accounting transactions other than compliance costs or maintenance of statutory records.

Does ACRA waive late penalties for first-time offenders?

Generally, no. Penalties are automated. However, you can submit an appeal via BizFile+ if you have a strong, valid reason (e.g., medical emergency), though waivers are rare.

About Koobiz

Navigating Singapore’s corporate regulations requires precision and expertise. Koobiz specializes in helping international and local entrepreneurs establish and manage their businesses in Singapore. From Company Incorporation and Bank Account Opening to Tax, Accounting, and XBRL Filing, our expert team ensures you remain compliant while you focus on business growth.

Need help with your 2026 Annual Return?

Contact Koobiz today for a consultation

Disclaimer: This article is for general informational purposes only and does not constitute legal or professional financial advice. All ACRA regulations, fees, and deadlines are subject to change. Readers should consult the official ACRA website or a qualified corporate secretary for the most current information specific to their business situation.