You may have successfully registered your company with ACRA, prepared the constitution, and submitted every passport copy and address proof requested by the bank. Yet the response is still the same: “We regret to inform you that your application has been unsuccessful.” No detailed explanation is provided. This has become a common experience for foreign-owned and newly incorporated companies in Singapore under the current tightened banking regulations.

At Koobiz, we frequently work with clients who are confused by this outcome. Many assume that meeting every listed requirement guarantees bank approval. In practice, “complete documents” only fulfill administrative checks. The final decision is driven by a deeper, often opaque, bank risk assessment process. In this article, we explain the real reasons behind corporate bank account rejections in Singapore, compare the risk appetite of different banks and fintechs, and outline the practical steps to take if your Singapore company has failed to secure banking approval.

Do “Complete Documents” Guarantee Corporate Bank Account Approval in Singapore?

No. Having a complete set of required documents does not guarantee corporate bank account approval in Singapore.

A complete checklist may allow the bank to open an application file, but it is only an administrative “entry ticket.” Final approval depends on risk factors that documents alone cannot demonstrate.

Here is why applications fail despite having “complete documents”:

- Regulatory Compliance (MAS Oversight): Banks must comply with strict Anti-Money Laundering (AML) regulations under MAS supervision. Beyond identity checks, they must assess the legitimacy of your funds and determine whether your profile presents a compliance risk.

- Risk Appetite (Internal Policy): Every bank has a specific “risk appetite.” Even if your business is fully legal, a bank may still decline the application if its internal policy currently excludes certain industries (such as crypto or general trading) to limit risk exposure.

- Qualitative Assessment (Business Logic): Compliance officers assess the intent behind the business. If the business plan lacks clarity or projected transaction volumes are inconsistent with the company’s capital profile, this qualitative assessment often leads to rejection.

In short, “complete documents” are necessary — but they are not sufficient for bank account approval in Singapore.

The Four Hidden “Soft Criteria” Behind Corporate Bank Account Rejections

There are four main “soft criteria” that banks scrutinize during their internal risk assessment: the clarity of wealth sources, the economic substance in Singapore, the complexity of ownership, and the capability of the directors.

Below, we contrast what you think you submitted versus what the bank actually sees to help you identify where the gap lies.

Unclear Source of Wealth vs. Source of Funds

Source of Wealth (SoW) and Source of Funds (SoF) are related but distinct. SoF focuses on where the specific deposited funds come from, while SoW examines how the Ultimate Beneficial Owner (UBO) accumulated wealth over time.

This distinction is the number one reason for rejection among wealthy applicants.

- What you submitted: A personal bank statement showing a balance of SGD 50,000 ready for deposit.

- What the bank looks for: “How did you generate this wealth over the last 10 years?”

- The Reality Gap: Demonstrating that you have funds (Source of Funds) is relatively straightforward. Explaining how that wealth was accumulated (Source of Wealth) is far more challenging. If you are a serial entrepreneur, do you have audit reports from previous companies? If you are an investor, can you show divestment proofs? If your narrative is “I saved it from my salary” but the amount exceeds typical savings for your profession, the bank perceives a money laundering risk. At Koobiz, we help clients build a robust SoW narrative supported by third-party evidence to bridge this gap.

Lack of Economic Substance in Singapore

Economic substance refers to the demonstrable presence of business activity within Singapore, such as having local employees, a physical office, or local customers, distinguishing a legitimate business from a “shell company.”

Singapore banks are under pressure to avoid servicing “shell companies” that use Singapore only as a tax haven conduit.

- What you submitted: A registered address at a popular provider in the CBD.

- What the bank looks for: “Does this company have a real footprint in Singapore, or is it a ghost entity?”

- The Reality Gap: From a founder’s perspective, a virtual office is cost-efficient. From the perspective of traditional banks such as DBS or OCBC, a shared address used by thousands of companies often signals limited commitment to the Singapore economy. If you have no local staff, no local suppliers, and no local customers, the bank sees high compliance costs with zero local economic benefit. While not illegal, this lack of substance often falls outside the risk appetite of Tier 1 banks.

Complex Ownership Structures

Complex ownership structures — involving multiple holding companies, offshore trusts, or shareholders based in high-risk jurisdictions — make it difficult for banks to clearly identify the Ultimate Beneficial Owner (UBO).

In banking compliance, transparency is the currency of trust.

- What you submitted: An organizational chart showing your Singapore company owned by a BVI Holding Co, which is owned by a Cayman Trust.

- What the bank looks for: Who is the individual ultimately exercising control over the company?

- The Reality Gap: You may view such a structure as asset protection or tax efficiency. Banks, however, often interpret it as opacity. Every layer of ownership requires the bank to perform due diligence on another jurisdiction, multiplying their compliance costs. If the cost of verifying a complex ownership structure outweighs the expected revenue from the account, banks may reject the application purely on efficiency grounds. A simple, direct ownership structure is always the path of least resistance.

The “Passive” Nominee Director Risk

A “passive” nominee director is appointed only to meet legal requirements but lacks real knowledge of the business. If they are unable to answer basic questions during a bank interview, the application is likely to fail.

This is a critical failure point for businesses using budget incorporation services.

- What you submitted: Form 45 signed by a local resident director.

- What the bank looks for: “Does the local leadership understand what this company does?”

- The Reality Gap: Banks often interview the local director to ensure oversight. If a bank officer asks the nominee director about projected revenue or key suppliers and the response is “I don’t know, please ask the foreign owner,” this signals a lack of effective local control. At Koobiz, our Nominee Directors are professionally briefed and understand their fiduciary duties, ensuring they can represent your company competently during compliance checks.

Traditional Banks vs. Digital Banks in Singapore: Understanding Risk Appetite

Finding the right banking partner is not about choosing the “best” bank, but the best fit for your specific business model. Many rejections stem from a mismatch between your company profile and the bank’s ideal customer.

Instead of comparing interest rates, you should compare “Risk Appetite.” Here is a guide to matching your business profile to the right institution.

The “Gold Standard” Route: Traditional Banks (DBS, OCBC, UOB)

Traditional banks are designed for companies with strong local substance. They are most suitable if you have a physical office, local employees, and complex financial needs such as trade financing or business loans.

- Best For: Manufacturing, wholesale trading with physical inventory, consultancy firms with a local team, and businesses that need Letters of Credit (LC) or overdraft facilities.

- The Trade-off: You gain high credibility and a full financial ecosystem. However, the cost is “high maintenance.” These banks typically require face-to-face interviews in Singapore, higher minimum deposits, and tangible proof of local operations. If you are a lean startup operating from a co-working space with no local employees, you may be flagged as higher risk simply because you do not fit the traditional banking profile.

The “Digital-First” Route: Fintechs & Neobanks in Singapore (Aspire, Airwallex, Wise)

Fintech solutions are designed for today’s borderless economy and are often the best fit for digital nomads, e-commerce sellers, and software companies operating with lean, remote teams.

- Best For: Dropshipping businesses, SaaS companies, digital marketing agencies, and foreign entrepreneurs who are unable to travel to Singapore for in-person interviews.

- The Trade-off: You get speed (accounts often open in days), a 100% online application process, and superior foreign exchange rates. The main limitation is the absence of traditional credit products, such as business loans or cheque facilities. For most new digital businesses, this trade-off is acceptable in exchange for securing a functional corporate account quickly. At Koobiz, we often recommend this route as a primary operational account for remote clients.

What Should You Do If Your Corporate Bank Account Application Is Rejected?

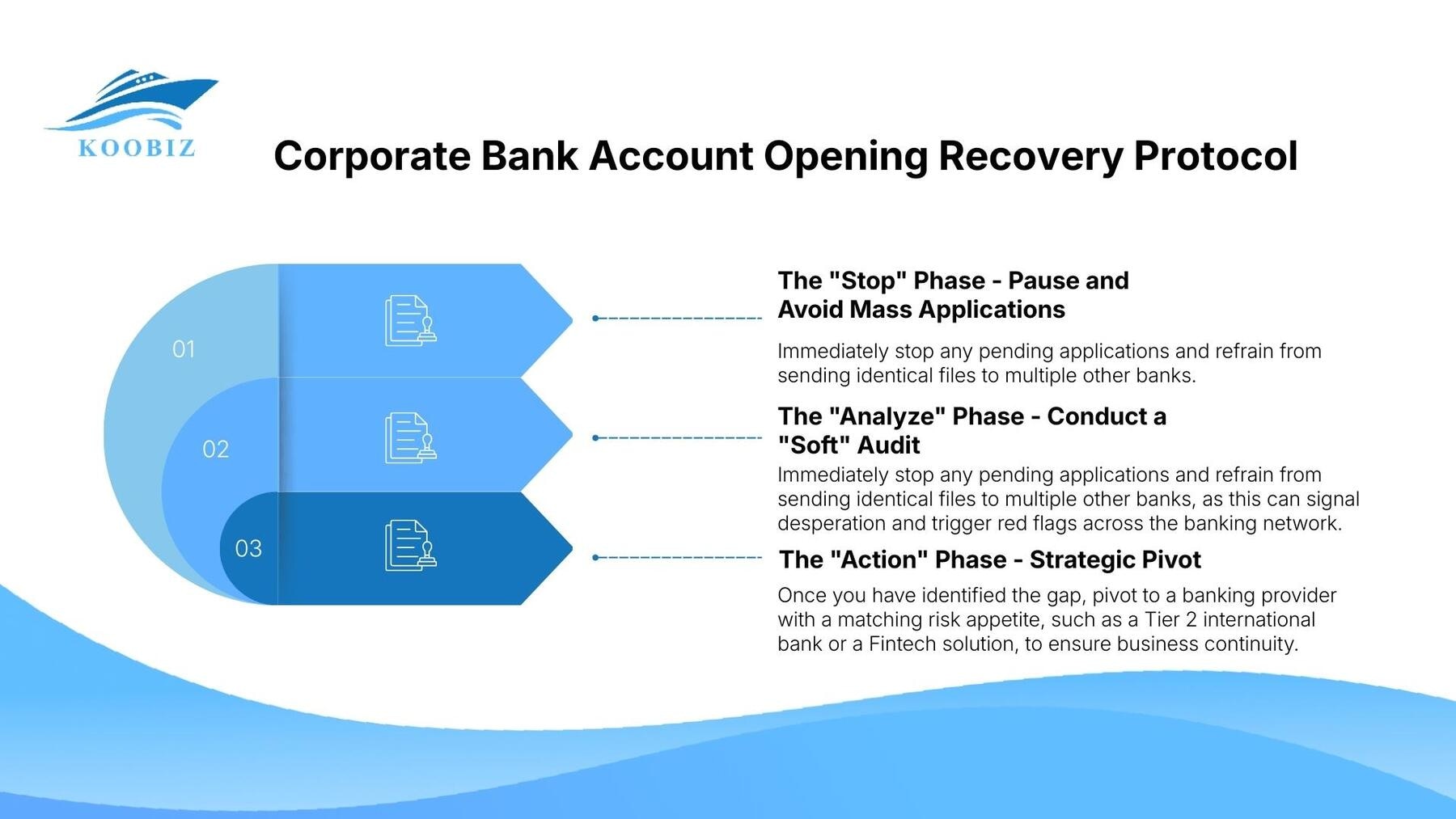

If your application is rejected, avoid panic and do not re-apply blindly. Instead, follow this three-step recovery protocol to diagnose the issue and secure an account without damaging your banking credibility.

Repeatedly applying to the same bank with the same documents will likely result in the same outcome. Here is the correct workflow to handle a rejection.

Step 1: The “Stop” Phase – Pause and Avoid Mass Applications

Immediately stop any pending applications and refrain from sending identical files to multiple other banks, as this can signal desperation and trigger red flags across the banking network.

Many applicants react to a rejection by applying to five other banks the next day. This is a mistake. Banks may share high-level compliance indicators across institutions. If you are rejected by Bank A for “unclear source of wealth,” Bank B might see that flag. The first step is to accept the rejection, take a breath, and request a “debrief” (though in rare cases, some bankers might hint at the reason informally). Attempting to argue or appeal without changing your business profile is futile.

Step 2: The “Analyze” Phase – Conduct a “Soft” Audit

Review your application against the “Hidden Soft Criteria” discussed earlier—specifically your Source of Wealth narrative and your company’s economic substance—to identify the likely cause of failure.

Assess your application from the bank’s perspective and address the questions that were never formally asked. Is your ownership structure too complex? Did your nominee director fail the interview? Was your business description too vague? Without fixing the root cause (e.g., clarifying your CV, adding a local customer contract), re-applying is futile. This is the stage where a professional pre-screening by Koobiz is most valuable.

Step 3: The “Action” Phase – Strategic Pivot

Once you have identified the gap, pivot to a banking provider with a matching risk appetite, such as a Tier 2 international bank or a Fintech solution, to ensure business continuity.

If you were rejected by a local giant (DBS/UOB), do not attempt to force approval Pivot to Tier 2 international banks (Maybank, RHB) which may have different exposure limits. Better yet, secure a Fintech account (Aspire, Airwallex) immediately. Having a functional corporate account with Aspire or Wise is far more practical than having no account while waiting for a traditional bank to reconsider. You can always re-apply to a traditional bank in 6-12 months once your company has a solid transaction history.

Specific High-Risk Scenarios That Trigger Banking Red Flags in Singapore

Certain business activities and owner profiles are classified as higher risk by banks, requiring Enhanced Due Diligence (EDD) and additional documentation to establish legitimacy.

If you fall into these categories, the concept of “complete documents” differs significantly from the standard checklist.

Below are the specific triggers and the exact remedies needed to pass compliance.

Business Nature: Crypto, Trading, and General Consulting

Businesses involved in cryptocurrency, high-volume general trading, or vague “management consulting” are flagged for deeper scrutiny because these sectors are statistically prone to money laundering and fraud.

- The Trigger: Using vague descriptions like “General Wholesale Trade” or “Management Consultancy,” or dealing in high-risk assets like crypto. Banks often view such descriptions as areas of limited transaction transparency.

- The Remedy: You must provide granular, transaction-level proof of business activity.

- For Trading: Submit actual invoices, Bills of Lading, or contracts with reputable counterparties (not just a generic supplier agreement).

- For Consulting: Provide a redacted service agreement showing the scope of work and hourly/project rates.

- For Crypto: You need a legal opinion letter confirming your token is not a security, plus proof of licensing or exemption from MAS.

The Impact of Nationality and Residency on Approval

Applicants from jurisdictions classified as higher risk or non-cooperative by the FATF (Financial Action Task Force) are subject to stricter compliance checks and may need to demonstrate stronger economic ties to Singapore.

- The Trigger: The Ultimate Beneficial Owner (UBO) holds a passport from a jurisdiction with weaker financial controls or heightened political risk (e.g., sanctioned countries or those on the FATF grey list).

- The Remedy: Enhanced Due Diligence (EDD) and proof of “Economic Nexus.”

- Economic Nexus: Relying solely on a nominee arrangement is often insufficient. You likely need a resident director with executive power (not just a statutory one) or a physical office lease.

- Source of Wealth: Be prepared for a more forensic-level review of your funds. Bank statements alone won’t suffice; you will need tax returns and property sale deeds from your home country to prove the legitimacy of your capital.

How Professional Pre-Screening Can Improve Corporate Bank Account Approval

Professional pre-screening is not just a document check; it is a strategic “stress test” of your entire application by a corporate service provider acting as an independent compliance reviewer.

Many applicants mistakenly believe that a corporate secretary simply forwards documents to the bank. At Koobiz, our pre-screening process is a rigorous technical audit designed to fix red flags before the bank ever sees them. Here is exactly how we bridge the gap between rejection and approval.

Step 1: The Narrative Audit (Source of Wealth Stress Test)

We deconstruct your Source of Wealth narrative to ensure it is supported by the specific proofs that compliance officers demand, eliminating vagueness.

Before you submit, we ask the questions the bank will ask: “Can you prove the dividend payout from your previous company?” or “Does your CV align with your current business capital?” We help you draft a clear, chronological narrative that connects your past success to your current deposit, ensuring the compliance officer does not need to infer the origin of your funds.

Step 2: Structure Optimization

We review your corporate structure to identify unnecessary complexities and advise on streamlining ownership layers to reduce compliance friction.

If you have a multi-layered structure involving BVI or Cayman entities that isn’t commercially necessary, we will advise you on the risks. Often, simplifying the structure to a direct ownership model—even temporarily—can be the difference between a swift approval and a prolonged or repeated rejection. We help you present the cleanest possible version of your company to the bank.

Step 3: Strategic Bank Matching

Instead of a broad, unfocused application approach, we match your specific risk profile to the bank with the highest probability of acceptance based on our real-time market data.

We know which banks are currently more open to new deposits and which are freezing new accounts for certain sectors. If you are a digital nomad, we steer you toward Fintechs like Aspire. If you are a high-volume trader, we prepare you for the specific interview questions of OCBC or UOB. We don’t just find you a bank; we find you the right bank.

If you are struggling with bank account rejection or want to ensure you get it right the first time, Koobiz is here to navigate the complexities of the Singaporean banking system for you. From incorporation to securing that vital bank account number, we provide the expertise to turn “complete documents” into a fully operational business.

Ready to address your corporate banking challenges in Singapore?

Visit Koobiz.com to explore our comprehensive Singapore Incorporation and Corporate Banking Support services. Let us handle the compliance so you can focus on the business.