Getting to grips with annual company requirements in Singapore might seem complex for new entrepreneurs. A top priority is knowing the due date for your company’s Annual General Meeting (AGM). . Failure to calculate AGM deadline Singapore dates correctly can lead to penalties and affect your company’s compliance standing.. At Koobiz, we know keeping track of these official dates can be tricky. This guide breaks it down clearly, showing you how to find your specific AGM deadline based on your company’s Financial Year End. We’ll also explain how it connects to filing your Annual Return and outline situations where you might not need to hold an AGM.

What is the AGM Requirement for Singapore Private Companies?

An Annual General Meeting (AGM) is a key yearly event where a company’s shareholders and directors come together. Its main purpose is to present the company’s financial statements, discuss its performance over the past year, and make important decisions about its future.

Think of the AGM as a cornerstone of good corporate governance. It ensures transparency and accountability, giving shareholders a formal opportunity to review the company’s health, ask questions of the leadership, and have their voices heard.

For private limited companies in Singapore, holding an AGM is a legal requirement. Even if a company is not actively trading or has only one shareholder, it must still follow the AGM rules—or formally complete the steps to be exempt from them. This is essential to keep your company in active (“Live”) and compliant standing with the national registry, ACRA.

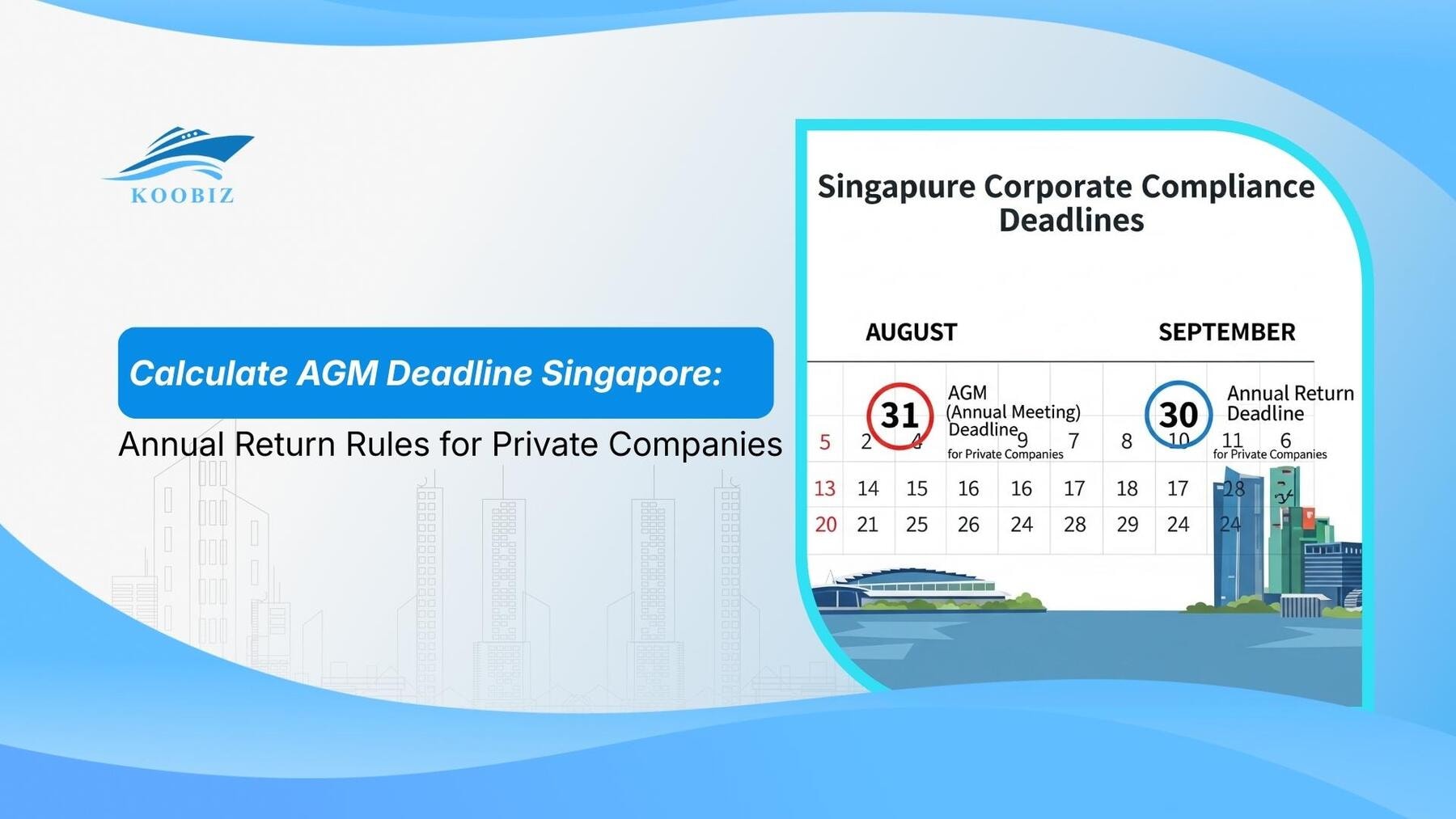

How to Calculate Your AGM and Annual Return Deadlines?

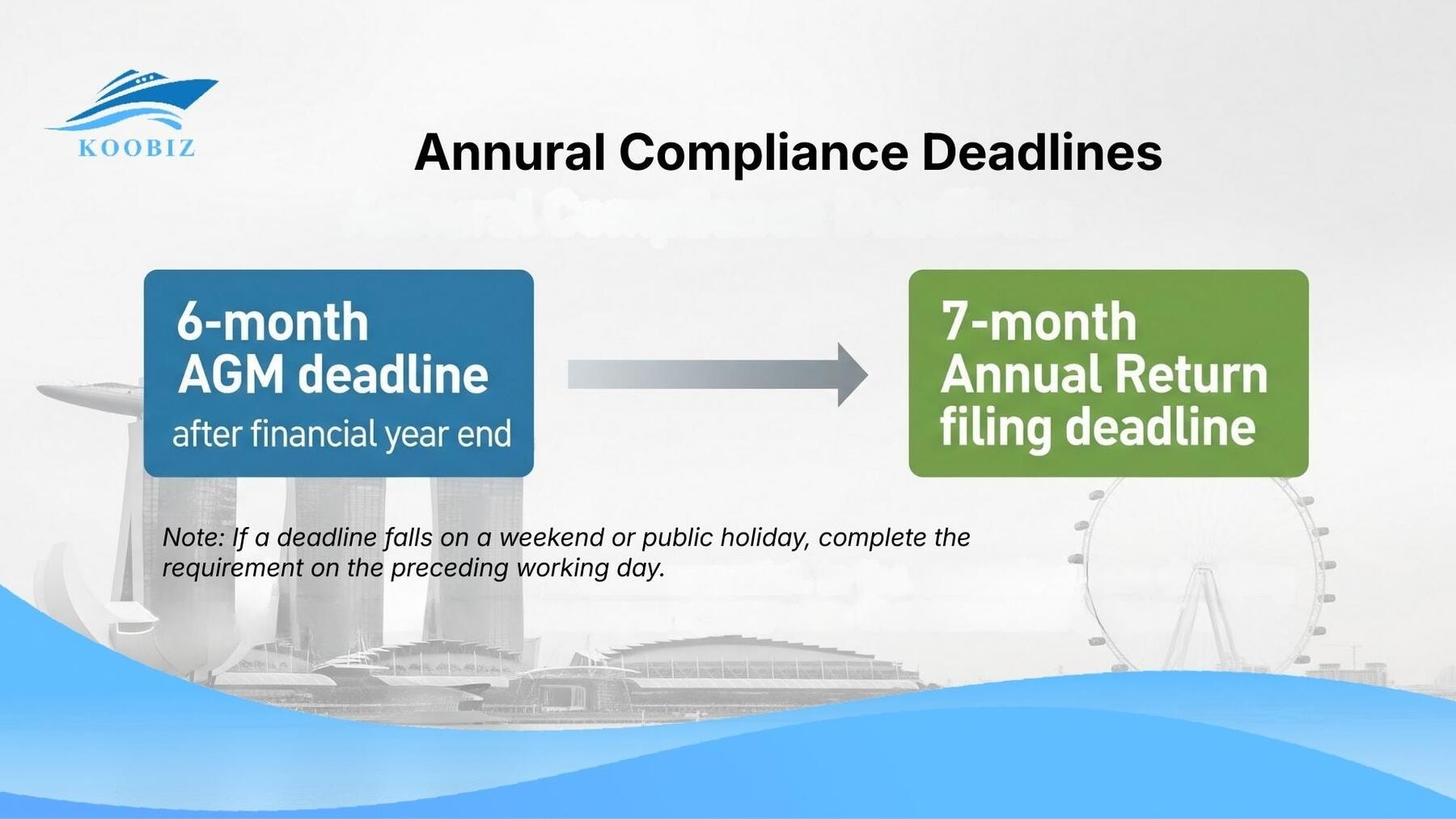

For private companies, the timeline is strict: hold the AGM within 6 months of the Financial Year End (FYE) and file the Annual Return within 7 months of the FYE.

All of these key dates are directly linked to your company’s unique FYE. Once that date is established, your annual compliance schedule becomes a regular, predictable cycle. This consistency allows both business owners and our team of corporate secretaries at Koobiz to plan effectively and ensure all obligations are met well ahead of time. For example, a company with a 31 December FYE knows its AGM is due by 30 June and its Annual Return must be filed by 31 July of the following year.

The 6-Month Rule Explained for Private Companies

Singapore’s Companies Act sets out clear rules for private companies regarding Annual General Meetings (AGMs) and annual filings. Here’s a simple breakdown of how the deadlines work:

1. The AGM Deadline: The law requires a private company to hold its AGM within 6 months after the end of its financial year. The financial reports presented at this meeting must be up-to-date, meaning they cannot be dated more than 6 months old at the time of the meeting.

2. The Filing Deadline: After the AGM, the company typically has 30 days to file its Annual Return (AR) with ACRA. This creates an effective final deadline of 7 months after the company’s financial year-end.

An Important Sequence: The AGM must happen before the Annual Return can be filed. This is because the filing process confirms to ACRA that the shareholders have officially reviewed and approved the company’s financial statements at the AGM (or have formally agreed to skip the meeting). You cannot submit the Annual Return until this step is complete.

In short: Hold your AGM by the 6-month mark, then file your Annual Return by the 7-month mark.

AGM Deadline Calculator Table (By FYE)

Use this table to quickly find your specific deadlines.

| Financial Year End (FYE) | Deadline to hold AGM (6 Months after FYE) | Deadline to file Annual Return (7 Months after FYE) |

|---|---|---|

| 31 March | 30 September | 30 October |

| 30 June | 31 December | 30 January (Next Year) |

| 30 September | 31 March (Next Year) | 30 April (Next Year) |

| 31 December | 30 June (Next Year) | 30 July (Next Year) |

Note: If a deadline falls on a weekend or public holiday, complete the requirement on the preceding working day.

Real-World Scenarios: Calculating Deadlines in Practice

These case studies illustrate how AGM and Annual Return deadlines apply to different corporate timelines, helping you visualize the process for your business.

Case Study 1: The Standard Calendar Year (FYE 31 December)

Company: TechGenius Solutions Pte. Ltd.

- Financial Year End: 31 December 2024.

- The Calculation:

- AGM Deadline: 30 June 2025 (6 months post-FYE).

- AR Filing Deadline: 30 July 2025 (7 months post-FYE).

- Outcome: Directors convene the AGM on 15 June 2025. The Annual Return is filed on 20 June 2025. The company remains compliant.

Case Study 2: The Mid-Year Fiscal Close (FYE 30 June)

Company: Oceanic Trading Pte. Ltd.

- Financial Year End: 30 June 2024.

- The Calculation:

- AGM Deadline: 31 December 2024.

- AR Filing Deadline: 30 January 2025.

- Outcome: The deadline falls on New Year’s Eve. The company secretary schedules the AGM for 10 December 2024 to avoid the holiday rush and prevent administrative oversight.

Case Study 3: Managing a Delay (Extension of Time)

Company: Creative Sparks Agency Pte. Ltd.

- Financial Year End: 31 March 2024.

- The Calculation:

- Original AGM Deadline: 30 September 2024.

- The Situation: In mid-August, directors realize the audit won’t be ready due to complex overseas transactions.

- Correct Action: They apply for an Extension of Time (EOT) via BizFile+ on 1 September 2024, paying the SGD 200 fee.

- New Deadline: ACRA grants a 30-day extension, moving the deadline to 30 October 2024. The meeting is held on 25 October, avoiding penalties.

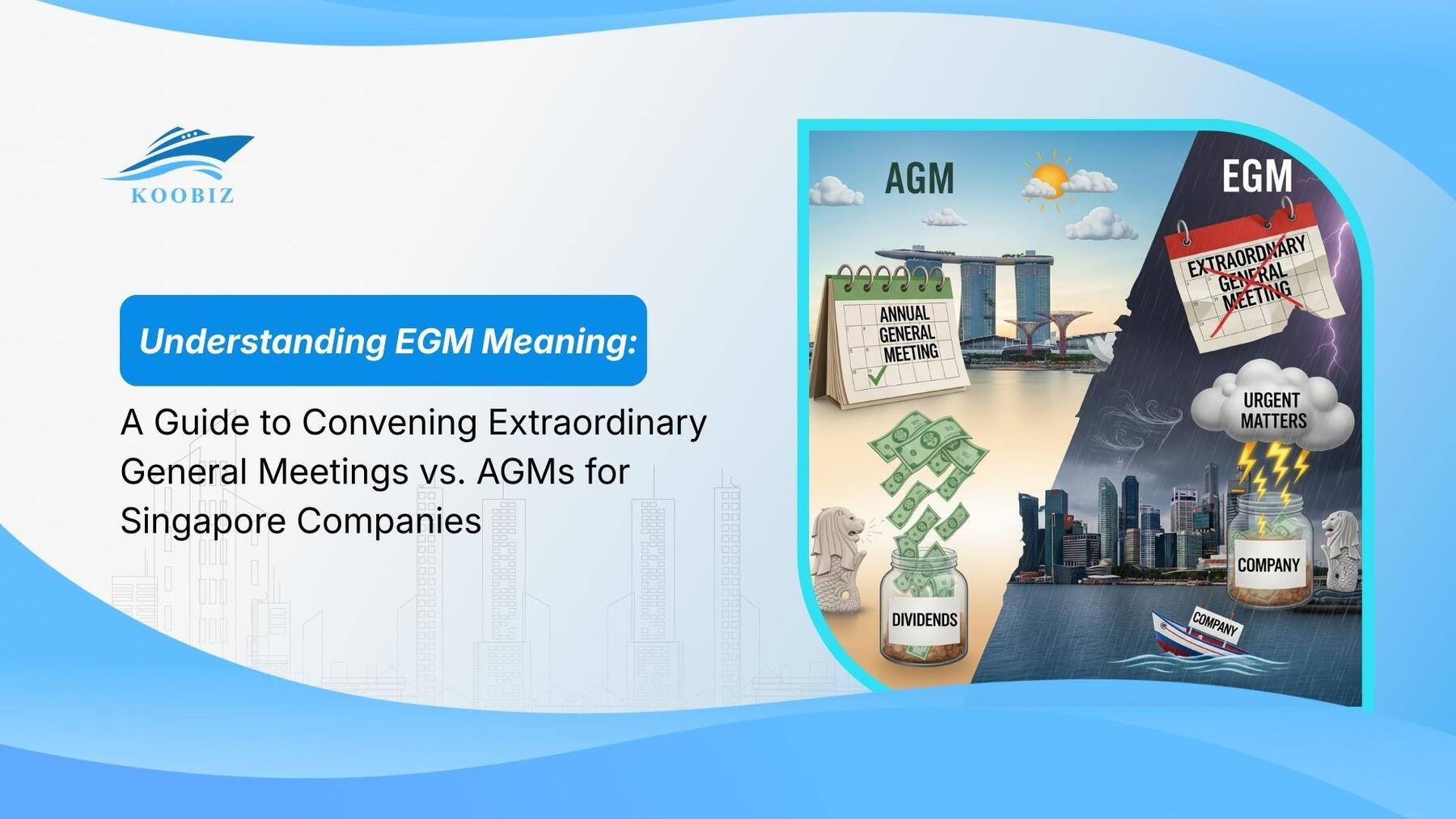

AGM vs. Annual Return: Understanding the Difference and Connection

Think of the Annual General Meeting (AGM) as your company’s internal approval process, and the Annual Return as its external notification duty. These two events are often mistaken for being the same, but they serve distinct purposes. In simple terms, the AGM is about governance—securing shareholder approval for your company’s direction and financials. The Annual Return is about disclosure—officially updating the national registry (ACRA) with your company’s current information.

| Feature | Annual General Meeting (AGM) | Annual Return (AR) |

|---|---|---|

| Primary Purpose | Internal Governance (Approval) | External Disclosure (Reporting) |

| Key Action | Directors present financial statements; Shareholders vote to adopt them. | Company officers submit details to ACRA via BizFile+ (e.g., officers, address, financials). |

| Audience | Shareholders & Directors | The Public & The Regulator (ACRA) |

| Sequence | Must happen first (within 6 months of FYE). | Must happen after the AGM (within 7 months of FYE). |

| Pre-requisite | Accounts must be ready for presentation. | AGM must be concluded (or dispensed with). |

The connection is linear: You generally cannot file the Annual Return until the AGM is concluded (or validly dispensed with) because the filing requires the AGM date.

Key Agenda Items: What Must Be Discussed at an AGM?

A valid Annual General Meeting (AGM) typically follows a formal agenda with several key items. For a private limited company in Singapore, these usually include:

- Adoption of Accounts: The board of directors presents the company’s financial reports. The shareholders then review and formally approve these documents.

- Director Re-election: In accordance with the company’s constitution, certain directors may retire from their position and stand for re-election by the shareholders.

- Dividend Declaration: If the company has made a profit, the directors may propose a final dividend. Shareholders will then vote on whether to approve this payout.

- Auditor Appointment/Re-appointment: Shareholders are responsible for appointing (or reappointing) an external auditor for the upcoming financial year and approving their fees. (Note: “Exempt Private Companies” may be relieved from this requirement.)

The AGM may also address “Special Business,” which covers other significant changes like altering the company’s name, provided that proper advance notice has been given to all shareholders.

Can Private Companies Dispense with Holding AGMs?

Yes, private companies in Singapore can be exempt from holding a formal Annual General Meeting if they meet certain conditions. This exemption is known as “dispensing” with the AGM. It’s important to understand that dispensing with an AGM does not mean you can skip preparing financial statements or filing your Annual Return. It simply means you do not need to hold a physical or online meeting. This helps reduce the administrative load for small private companies. Even if the AGM is dispensed with, the Annual Return must still be filed within 7 months of your financial year-end.

Criteria for AGM Exemption

A private company does not need to hold an AGM if it meets one of the following criteria:

- Resolution to Dispense: All shareholders pass a formal resolution agreeing to dispense with AGMs. This decision remains valid until the shareholders decide to change it.

- Sending Accounts Early: The company sends its financial statements to all shareholders within 5 months of the financial year-end. If no shareholder requests an AGM within 14 days of receiving the documents, the requirement for a meeting is automatically waived.

- Dormant Relevant Company: A company that is officially classified as “dormant” by ACRA and is exempt from preparing financial statements is also exempt from holding an AGM.

What Happens If You Miss the AGM Deadline?

Missing the AGM or Annual Return deadline triggers immediate action from ACRA, including fines and the possibility of legal prosecution for directors.

ACRA holds directors personally responsible for compliance. Late filings will lower your company’s public compliance rating, which can harm your reputation with banks and potential partners. Even if your company is in “Live” status, it is still subject to penalties for late submissions.

ACRA Penalties and Late Lodgment Fees

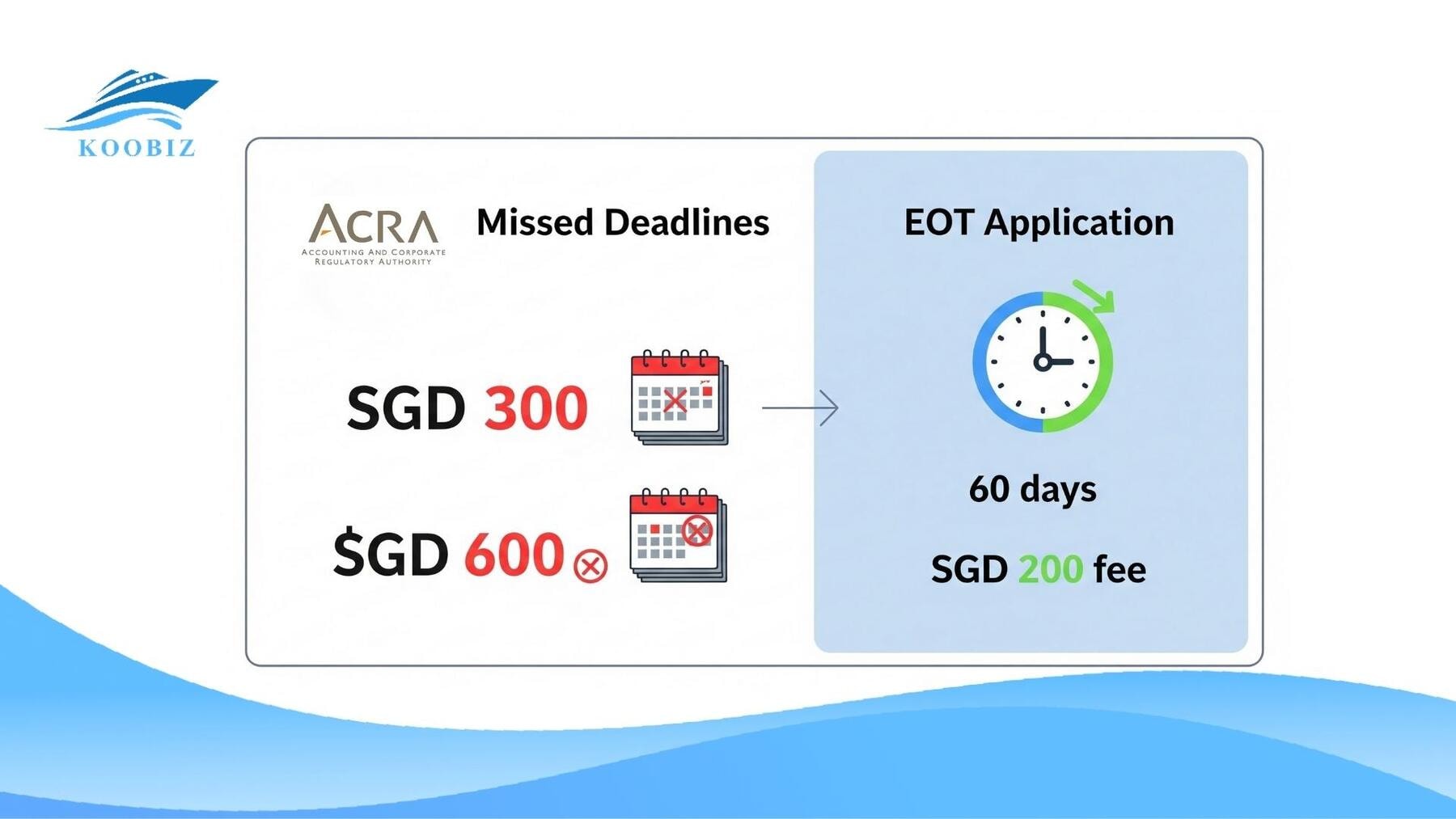

ACRA imposes two types of penalties:

- Late Lodgment Fee: Payable when filing the Annual Return.

- Up to 3 months late: SGD 300.

- Over 3 months late: SGD 600.

- Composition Fines: A separate fine offered to directors to settle the breach of failing to hold the AGM. This starts at SGD 300 per breach and increases based on the delay and previous offenses.

How to Apply for an Extension of Time (EOT)

If you foresee missing a deadline, you can apply for an Extension of Time (EOT) before the original deadline passes.

Apply online via the BizFile+ portal for an extension of up to 60 days.

The application fee is SGD 200.

It is very rare for ACRA to approve extensions requested after the deadline has already passed.

Conducting Virtual AGMs in Singapore

Since 2023, companies can permanently hold virtual or hybrid AGMs if their constitution allows it and technological safeguards are in place.

Previously a temporary COVID-19 measure, this is now permanent under the Companies Act. Companies can hold fully virtual or hybrid meetings. To conduct a valid virtual AGM, ensure:

- Attendees are verified.

- Voting happens in real-time.

- Shareholders can ask questions live.

- The technology is secure and reliable.

If your constitution prohibits virtual meetings, you must amend it before holding one.

Conclusion

Managing your corporate calendar is essential for business operations in Singapore. Whether you need to calculate AGM deadline Singapore dates or prepare financial statements, accuracy prevents unnecessary fines. Failing to adhere to the 6-month rule leads to administrative headaches.

At Koobiz, we specialize in Singapore statutory compliance. From acting as your Company Secretary to preparing financial statements and filing Annual Returns, we ensure you never miss a deadline. If you are unsure about your status or need an Extension of Time, Koobiz is here to help.

$$Visit Koobiz.com to explore our Corporate Secretarial Services$$