IMPORTANT UPDATE (Late 2025): Corporate Cheque Phase-Out

- Corporate Cheque Books: As of mid-to-late 2025, major financial institutions have officially discontinued issuing new cheque books to corporate entities.

- Final Grace Period: The deadline for clearing and processing existing corporate cheques is strictly set for 31 December 2026.

- Mandatory Digital Transition: To avoid business disruption, entities must migrate to PayNow Corporate, FAST, or GIRO before the 2026 cutoff.This guide remains fully applicable for Individual/Personal Cheques, which will continue to be accepted beyond 2026 (transitioning to the CTS Lite system in 2027).

While Singapore’s financial landscape is rapidly digitizing via PayNow and FAST, mastering the legacy skill of cheque writing remains indispensable for high-value transactions and final corporate settlements. Whether you are paying a vendor or settling rent, a correctly filled cheque ensures your transaction is processed smoothly by major local banks like DBS, OCBC, and UOB.

At Koobiz, where we specialize in Singapore company incorporation and bank account opening services, we help businesses navigate this transition from traditional banking to modern digital solutions. This comprehensive guide covers the precise writing process, security features, and the critical timeline for the corporate cheque sunset.

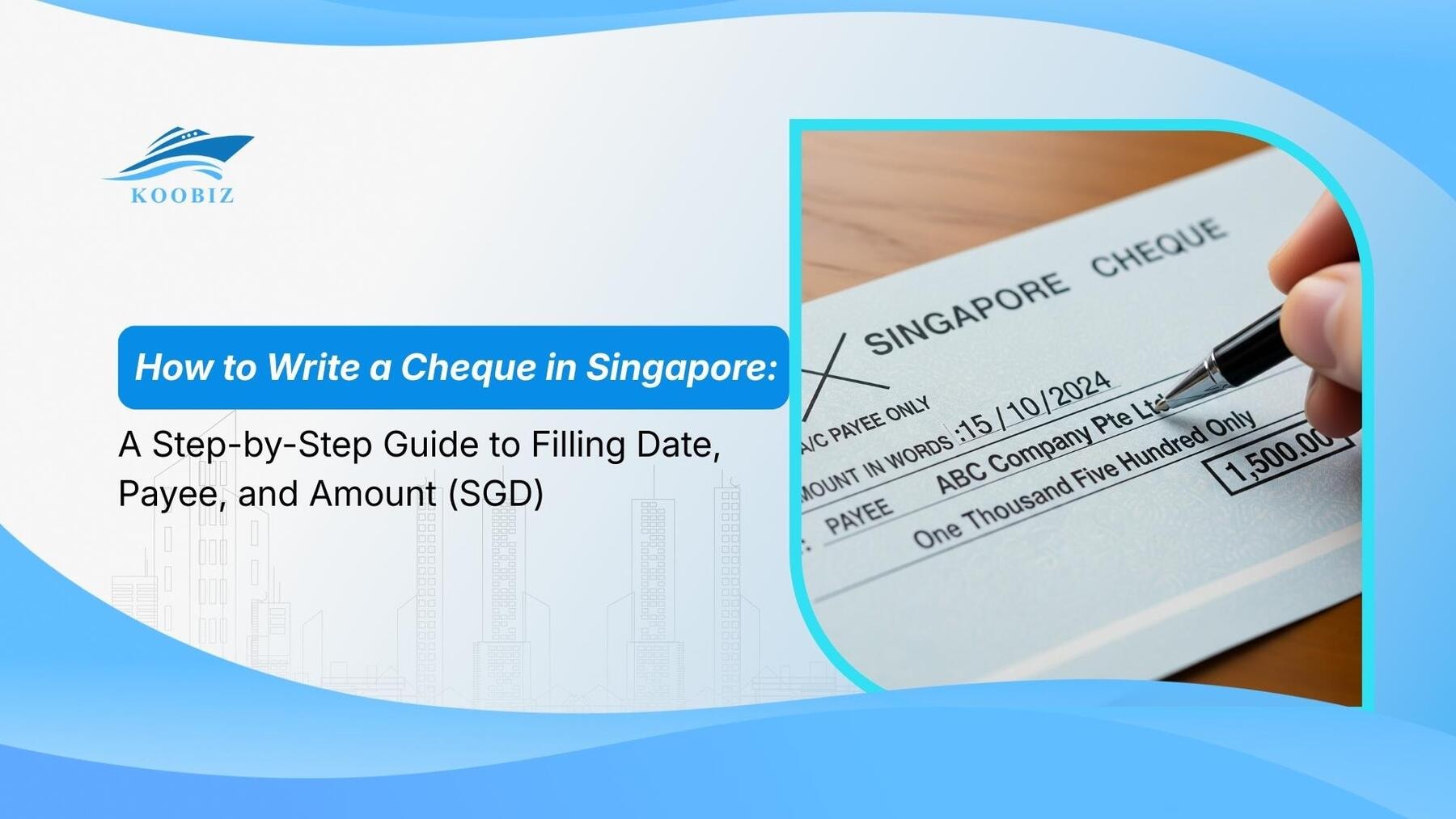

What are the Mandatory Parts of a Singapore Cheque?

To comply with Cheque Truncation System (CTS) standards, every Singapore cheque must feature six accurately completed components:

- Date Line: Located at the top right, this dictates the earliest date of encashment and starts the 6-month validity clock.

- Payee Line: Situated next to ‘Pay’, where the recipient’s full legal name must be entered precisely.

- Amount in Words: The sum written in full English text, traditionally ending with ‘Only’.

- Amount in Figures: The numerical sum entered in the rectangular box, preceded by the S$ symbol.

- Authorized Signature: Located at the bottom right; the signature must strictly align with your bank’s mandate.

- MICR Band: The specialized coding at the bottom. Strictly avoid writing or stamping in this zone to prevent clearing errors.

How to Write a Cheque in 6 Simple Steps

Adhering to this 6-step protocol ensures your transaction is processed seamlessly through the Cheque Truncation System (CTS).

Step 1: Date Entry (DD/MM/YYYY).

Always fill in the date first. A blank date field is a major security vulnerability that could lead to unauthorized encashment.

Expert Tips:

- Abbreviated months (e.g., “25 Dec 2025”) are acceptable if legible.

- Post-dating: You can write a future date (e.g., for rent), and the bank will not process it until that day.

- Never leave blank; it poses a security risk.

Step 2: Recipient Verification.

For individuals, the name must strictly mirror their NRIC or Passport. Any legal name discrepancy is a leading cause for immediate rejection.

Expert Tips:

- Corporates: Use full entity name (e.g., “Koobiz Pte. Ltd.”), not abbreviations unless officially recognized.

- Individuals: Match the name in their NRIC/Passport exactly.

- Security: Draw a horizontal line through any empty space after the name to prevent additions.

Step 3: Security Crossing.

Drawing two parallel lines ensures the funds are ‘Account Payee Only’. For maximum security, always strike out ‘Or Bearer’ to prevent cash withdrawals.

Expert Tips:

- This makes it a “Crossed Cheque” (Account Payee Only).

- It ensures funds must go into a bank account and cannot be cashed over the counter.

- Strike out “Or Bearer” for added security.

Step 4: Legal Tender in Words.

Write the amount clearly and conclude with ‘Only’. This prevents any fraudulent additions and confirms the finality of the sum.

Expert Tips:

- Example: “One Thousand Five Hundred Dollars and Cents Fifty Only”.

- The word “Only” prevents fraudsters from adding “and Thousand more”.

- If handwriting is messy, print in block letters.

Step 5: Numeric Entry.

Clear numerical entry is vital. Position the first digit directly adjacent to the S$ symbol to prevent fraudulent insertions.

Expert Tips:

- Example: “1,500.50”

- Place the first digit close to the “S$” symbol to prevent inserting extra numbers (e.g., turning $100 into $9,100).

- Always denote cents, utilizing ‘.00’ for whole dollar amounts to ensure the figure is legally unambiguous.

Step 6: Authorized Signature.

Apply your signature in the designated area, ensuring it strictly matches the official mandate registered with your bank.

Expert Tips:

- Corporate Compliance: Ensure the signing follows your Board Resolution requirements (e.g., Joint Signatories or inclusion of the Company Stamp).

- Do not let the signature cross into the MICR band (bottom numbers).

Crossed Cheque vs. Cash Cheque: What is the Difference?

Mastering the distinction between cheque types is a fundamental safeguard for your business’s liquidity and security. In the Singapore business landscape, Crossed Cheques are the industry standard, accounting for approximately 90% of all B2B cheque transactions.

| Feature | Crossed Cheque (Account Payee Only) | Cash Cheque (Open Cheque) |

|---|---|---|

| Mechanism | Visual Identifier: Distinguished by two parallel diagonal lines in the top left corner, often accompanied by the ‘Account Payee Only’ mandate. | No lines on top left; “Or Bearer” is left intact. |

| Security | High. Fraud Prevention: In the event of loss or theft, these lines strictly prohibit over-the-counter encashment by unauthorized parties. | Low. Essentially like cash. Anyone holding the cheque can claim the funds. |

| Encashment | Funds must be deposited into a bank account. | Allows for immediate liquidity at any bank branch, but poses a significant security risk as anyone holding the document can claim the funds. |

| Best For | Suppliers, rent, salaries, mailing payments. | Petty cash, emergencies, recipients without bank accounts. |

Practical Applications: Scenario-Based Guide

Scenario A: Paying Monthly Office Rent (Crossed Cheque)

- Payee: Ensure the legal entity name matches exactly: ‘Central Plaza Holdings Pte Ltd‘.

- Amount: “Four Thousand Five Hundred Dollars Only” (Words) and “4,500.00” (Figures).

- Security: Cross the cheque (top left lines) and strike out “Or Bearer”.Compliance Result: The funds are restricted to bank deposit only, eliminating the risk of unauthorized cashing if intercepted.

Scenario B: Petty Cash Withdrawal (Cash Cheque)

How to Write It:

- Pay: “Cash” or “Tan Wei Ling”.

- Amount: “Two Hundred Dollars Only” (Words) and “200.00” (Figures).

- Liquidity: Do NOT cross the cheque. Leave “Or Bearer” intact.Liquidity Outcome: While providing instant over-the-counter cash, this method requires strict physical custody of the cheque.

The Corporate Cheque Sunset & Digital Migration

Immediate Action Required: As Singapore officially phases out corporate cheques by 31 December 2026, businesses must migrate to digital clearing systems now.

The Strategic Move to Digital: Why the Shift?

Driven by the Monetary Authority of Singapore (MAS), this nationwide transition aims to eliminate inefficient manual processing costs and fortify payment security against fraud.

| Feature | Cheque | PayNow Corporate / FAST |

|---|---|---|

| Transaction Cost | High Overhead: Banks typically levy charges ranging from S$0.75 to S$3.00 per leaf. | Cost-Efficient: Often free or minimal, depending on your corporate banking tier. |

| Processing Speed | Delayed: Subject to a 1–2 business day clearing cycle. | Immediate: Real-time fund transfers available 24/7. |

| Operational Ease | Manual Labor: Mandates physical signatures and manual bank-in procedures. | Seamless: Remotely authorized via secure digital tokens or mobile applications. |

| Transparency | Fragmented: Relies on physical image retrieval for auditing. | Transparent: Offers an instantaneous digital reference for simplified reconciliation. |

Future-Proof Your Business: If your operations still rely on paper-based payments, now is the time to transition. At Koobiz, we specialize in integrating PayNow Corporate into your financial ecosystem, ensuring full compliance before the 2026 deadline.

Common Cheque Writing Mistakes and How to Avoid Them

Zero-Tolerance Policy: Correction Fluid.

The use of white-out or correction tape is strictly prohibited under CTS standards as it interferes with high-speed digital scanning.

- The Corrective Protocol: For minor errors, draw a single horizontal line through the mistake, write the correct entry, and affix a full countersignature (not initials) directly adjacent to the change.

- Critical Compliance Note: Alterations are never permitted on an Image Return Document (IRD). If an IRD is issued, you must void the transaction and issue a fresh cheque leaf.

Mismatched Amounts

While legal statutes specify that words prevail over figures, Singapore banks will almost certainly reject mismatched cheques as a primary fraud prevention measure.

Frequently Asked Questions About Cheques in Singapore

What is the clearing time for cheques in Singapore?

- Mon-Thu (Before 3:30 PM): Clears next business day (Day 2) after 2:00 PM.

- Friday (Before 3:30 PM): Clears Monday after 2:00 PM.

- Friday (After 3:30 PM) or Weekends: Clears Tuesday after 2:00 PM.

Can I still use cheques after 2025?

- Personal Cheque Outlook: Individuals can continue using personal cheques, which will transition to the enhanced CTS Lite system starting in 2027.

- Mandatory Corporate Sunset: Cheque processing for all corporate entities will strictly cease after 31 December 2026. New cheque book issuance has already been discontinued.

How do I stop payment on a lost cheque?

Stop Payment Protocols: Banks typically levy a service fee ranging from S$15 to S$30 per instruction; ensure you provide the exact cheque number for immediate action.

Can I write a USD amount on a standard SGD cheque?

Currency Integrity: Standard cheque leaves are designated for SGD transactions only. Attempting to issue USD or other foreign currencies on an SGD leaf will trigger an immediate compliance rejection.

The Koobiz Advantage: Beyond incorporation, we are your strategic partner in navigating Singapore’s digital banking evolution. From KYC readiness to PayNow Corporate integration, we de-risk your financial operations, allowing you to scale with absolute confidence. Visit us at koobiz.com to future-proof your business payments today.