Issuing a share certificate is a key legal step, not just paperwork. It is the official proof of ownership for anyone holding a stake in your Singapore company. For business owners in Singapore, understanding the nuances of Section 123 of the Companies Act 1967 is essential to avoid governance disputes and ensure full compliance with the Accounting and Corporate Regulatory Authority (ACRA). Whether you are a startup founder distributing initial equity or an established firm managing a share transfer, the validity of this document underpins the trust in your corporate structure.

At Koobiz, we understand that navigating corporate secretarial duties can be complex. This guide aims to demystify the process, answering exactly what a share certificate is, how to issue it correctly, and how to handle modern exceptions like electronic versions or lost documents. Below, we break down the rigorous standards required to ensure every certificate you issue is fully compliant and legally binding.

What is a Share Certificate in Singapore Law?

A share certificate is a legal document that serves as the main proof of ownership for the shares it lists. Singapore law requires companies to prepare and have this document ready for the shareholder within 60 days of issuing new shares or within 30 days after the lodging of a transfer.

Think of it this way: owning a share is like owning a right in the company, and the certificate is the official paper (or digital file) that confirms you hold that right. While the Electronic Register of Members (EROM) hosted by ACRA and updated by the company via BizFile+ is the primary official record, the shareholder keeps the certificate as their personal proof.

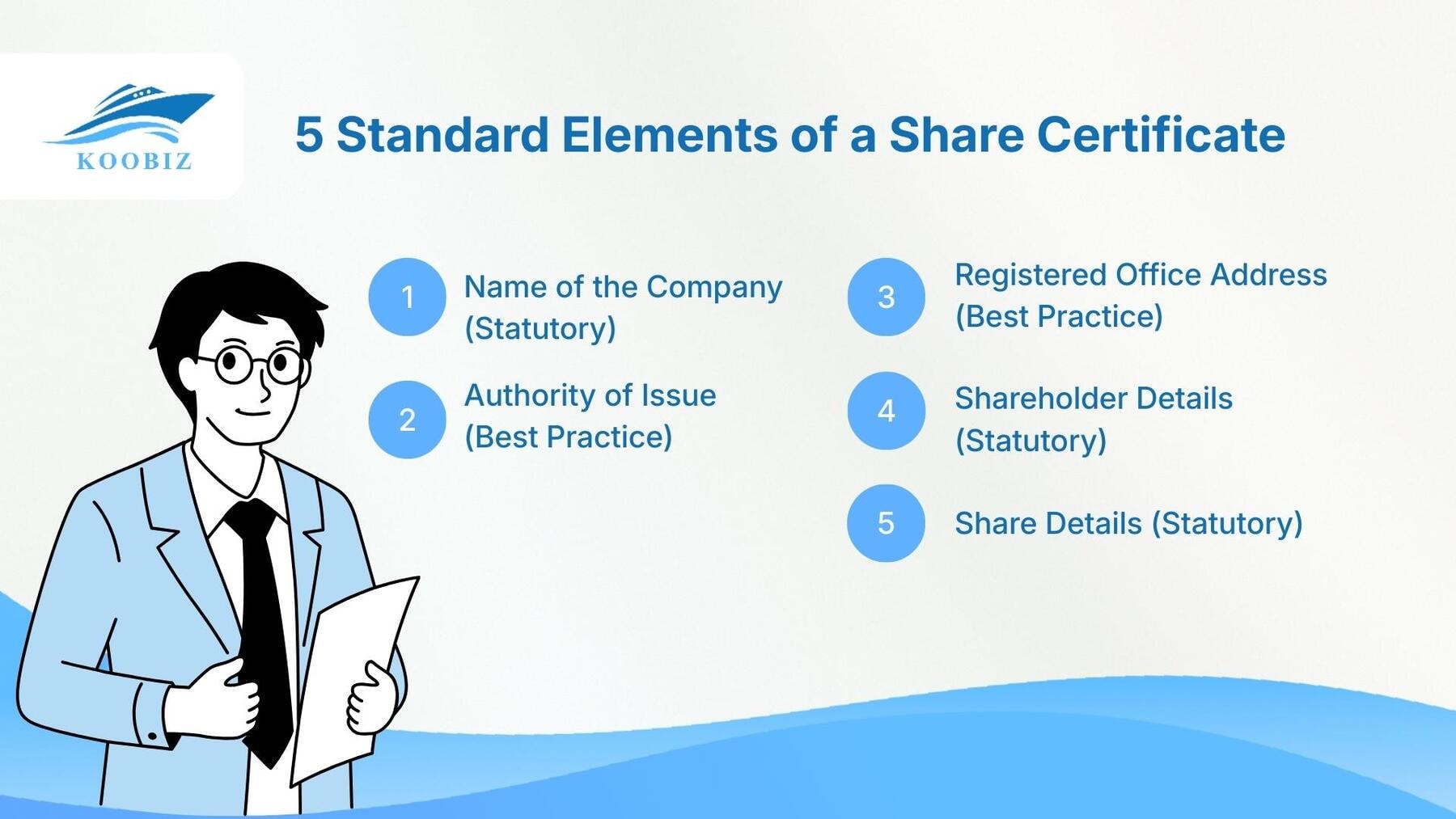

Mandatory Particulars: What Must Be Included in a Share Certificate?

For the certificate to be legally valid, it must contain specific details.

The five standard elements include:

- Name of the Company (Statutory): This must be the exact registered name as it appears in ACRA’s records, including the suffix (e.g., Pte. Ltd.).

- Authority of Issue (Best Practice): It is standard practice to state the law under which the company is constituted (usually “Incorporated in the Republic of Singapore under the Companies Act 1967”).

- Registered Office Address (Best Practice): Including the current registered address of the company helps identify the entity clearly, though not strictly mandated by the Act itself.

- Shareholder Details (Statutory): The full name and address of the registered owner (the member).

- Share Details (Statutory): This is the core data required by law, which must specify:

- The Class of Shares (e.g., Ordinary, Preference).

- The Number of Shares held.

- The Amount Paid-up on the shares (or legally deemed to be paid up).

Ensuring the “amount paid” is accurate is crucial, as it protects the shareholder from being asked for more money later. At Koobiz, we double-check that this information matches your ACRA filings perfectly.

Step-by-Step Guide to Issuing Share Certificates

Follow these four clear steps to issue a certificate correctly:

Step 1: Allotment of Shares

The process starts when your company agrees to issue new shares, usually to an investor in exchange for capital. This agreement should be documented.

Step 2: Board Resolution

The company’s Directors must officially approve the share issuance by passing a Board Resolution. This resolution authorizes who gets the shares, how many, and approves the creation and signing of the certificates.

Step 3: Updating the Electronic Register of Members (EROM) with ACRA

Your company must update the national Electronic Register of Members (EROM) on the BizFile+ portal. This is the official moment the person becomes a shareholder on record. Your Company Secretary typically handles this filing.

Step 4: Preparation and Signing of the Certificate

Finally, prepare the certificate with all the required information. It is then signed by the authorized company officers.

Executing the Document: Common Seal vs. Authorized Signatures

You have two main options for signing, offering flexibility, especially for companies with overseas directors.

The table below outlines the key differences and requirements for each method:

| Feature | Method 1: Using Common Seal | Method 2: Authorized Signatures (No Seal) |

|---|---|---|

| Applicability | Mandatory if specified in the Company Constitution. | Standard for modern companies (or if Constitution allows). |

| Process | Physical embossing of the metallic seal onto the paper. | Wet ink signatures or secure digital signatures. |

| Authorized Signatories | • Two Directors

• One Director + Company Secretary |

• Two Directors

• One Director + Company Secretary • One Director + Witness (attesting the signature) |

| Best For | Traditional companies preserving formality. | Modern companies with international or remote directors. |

This flexibility is particularly beneficial for companies with international directors who may not be physically present in Singapore to apply a physical seal. At Koobiz, we often advise clients on structuring their Constitution to allow for this modernized execution method, facilitating smoother remote operations.

Practical Example: Issuance of Shares for a New Investor

Let’s see how this works for a fictional company, “FutureTech Pte. Ltd.”.

The Scenario:

FutureTech Pte. Ltd. has secured a new angel investor, Mr. John Tan, who is investing SGD 50,000 in exchange for 10,000 ordinary shares.

The Execution Workflow:

- Board Approval: The Directors pass a Board Resolution approving the allotment of 10,000 shares to Mr. Tan. The resolution explicitly authorizes the issuance of Share Certificate No. 005.

- ACRA Filing: The Company Secretary logs into BizFile+ and files the “Return of Allotment”. This updates the Electronic Register of Members (EROM) to reflect Mr. Tan’s ownership effective from the filing date.

- Certificate Preparation: The Secretary prepares the certificate with the following details:

- Certificate No: 005

- Member: Mr. John Tan

- Shares: 10,000 Ordinary Shares

- Paid-Up: SGD 50,000 (Fully Paid)

- Signing (Modern Method): As FutureTech does not use a common seal, the certificate is signed by one Director and the Company Secretary.

- Delivery: The signed certificate is delivered to Mr. Tan within 60 days of the allotment.

Managing Share Certificate Lifecycle: Digital Requirements & Lost Certificates

Managing the lifecycle of share certificates involves not just their creation, but also handling modernization trends and unfortunate events like loss or destruction.

Digital Share Certificate Requirements 2025: Are They Legal?

Yes, electronic share certificates are fully legal in Singapore if your company’s Constitution allows it. They offer better security and are easier to store and share. Important: A digital certificate isn’t just a scanned PDF. It should be properly executed with secure digital signatures to ensure it can’t be tampered with. Koobiz strongly encourages modern startups to adopt electronic records early, as this simplifies future due diligence processes where investors will ask for a “Data Room” containing all these documents.

How to Replace a Lost Share Certificate in Singapore

If a shareholder loses their certificate, the company must follow a secure process to issue a replacement and protect against fraud.

The replacement process typically requires:

- Statutory Declaration: The shareholder must sign a legal declaration confirming the certificate is lost and has not been pledged or sold.

- Letter of Indemnity: The shareholder promises to compensate the company for any loss arising from the issuance of the replacement.

- Payment of Fees: The company may charge a nominal fee for the replacement (up to SGD 2.00).

- Public Notice (Optional but Recommended): In some cases, notice must be given to the public before a replacement is issued to ensure no other party claims title.

Once these documents are received, the Directors pass a resolution to cancel the old certificate number and authorize the issuance of a new one.

Is Stamp Duty Required for Issuing New Share Certificates?

No, stamp duty is generally not required for the issuance of new share certificates during an allotment, but it is applicable for certificates issued pursuant to a transfer of shares.

It is crucial to distinguish between “Allotment” (New Shares) and “Transfer” (Existing Shares).

- New Allotment: When a company issues fresh shares to raise capital, there is no transfer of existing interest, so no stamp duty is payable to the Inland Revenue Authority of Singapore (IRAS).

- Share Transfer: If a certificate is issued because Shareholder A sold shares to Shareholder B, a Share Transfer Deed must be executed, and Stamp Duty (0.2% of the purchase price or market value, whichever is higher) must be paid. The new share certificate for Shareholder B should only be issued after the Stamp Duty has been paid and the transfer is registered.

Conclusion

Issuing proper share certificates is a fundamental part of trustworthy corporate governance in Singapore. From ensuring the mandatory particulars are accurate to choosing the right execution method (seal vs. signature), every step reinforces your company’s credibility.

While the process involves specific legal steps—allotment, resolution, and ACRA updates—it doesn’t have to be a burden. Whether you are moving towards electronic certificates or need to replace a lost document, professional guidance ensures you stay on the right side of the Companies Act.

About Koobiz

At Koobiz, we specialize in simplifying business compliance for Singapore companies. From incorporation and Company Secretary services to facilitating bank account opening and managing tax and accounting, we ensure your corporate governance is flawless. Let us handle the complexities of ACRA compliance so you can focus on growing your business.

Visit Koobiz.com today for expert assistance with your Singapore corporate needs.